Accounting software is becoming a must in our companies, and a company cannot manage its business without accounting software because these applications are easy and quick to provide the necessary information for the management, control, and decision making functions, and therefore companies must know the nature of their requirements of accounting software and others to choose the best software that helps the company accomplish its business the best way, perhaps we are providing a model for one of the best accounting software in Egypt and the Middle East, that has proven a great success in many companies, with a variety of their activities, because it characterizes by comprehensiveness, the software provides a great model for general ledger software, which is suitable for different companies, whether small or medium-sized or large companies, and we will review AccFlex ERP general ledger software cycle as follows

AccFlex ERP General Ledger Software Cycle

AccFlex ERP general ledger software is considered to be two software in one software, as the software contains a module related to fixed assets management of the company, AccFlex ERP general ledger software cycle starts with the general settings

First, General Settings Menu

The general settings menu is the most important menus in AccFlex ERP general ledger software cycle, as the software is configured to operate in the system that is in the company and entering the basic data of the company and is divided into several screens

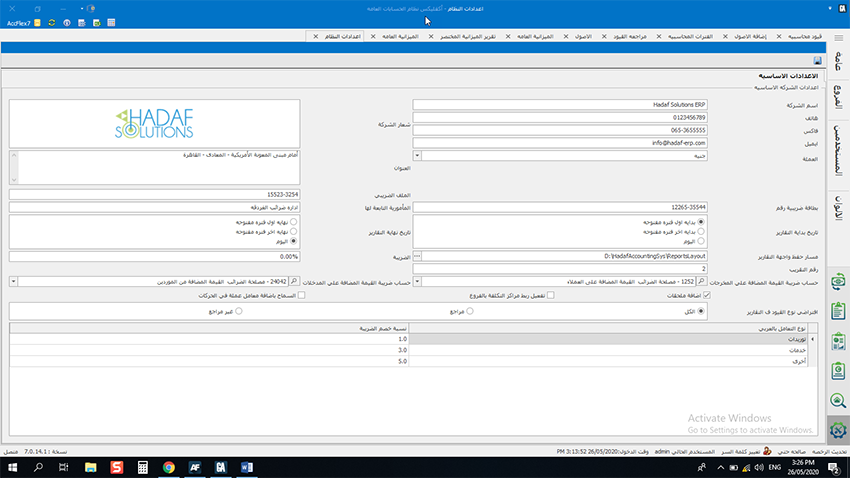

1- Basic Settings screen

Through it, the company's basic data are entered such as (company name- phone number- fax number- company address- company email- company logo- company base currency- taxpayer identification number- tax department that belongs to it) as well as selecting the company's fiscal year start date/end date, the default date for reports, the path for saving reports, the approximate figure of currencies, the calculation of input VAT and output VAT, and withholding tax rates, as well as allowing to add attachments to journal entries and allowing to add a currency factor in transactions.

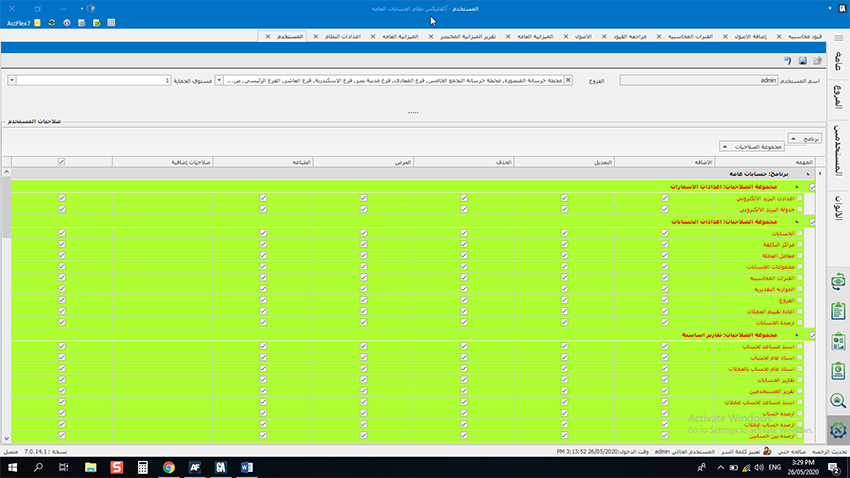

2- Users screen

Through it, an infinite number of users are created and the authorizations of each user are set up, whether (add- change- delete- ...) and the user can be created as “a system administrator” who has all the authorizations or specifying a specific user as a “Profile” and copying his authorizations to more than one user.

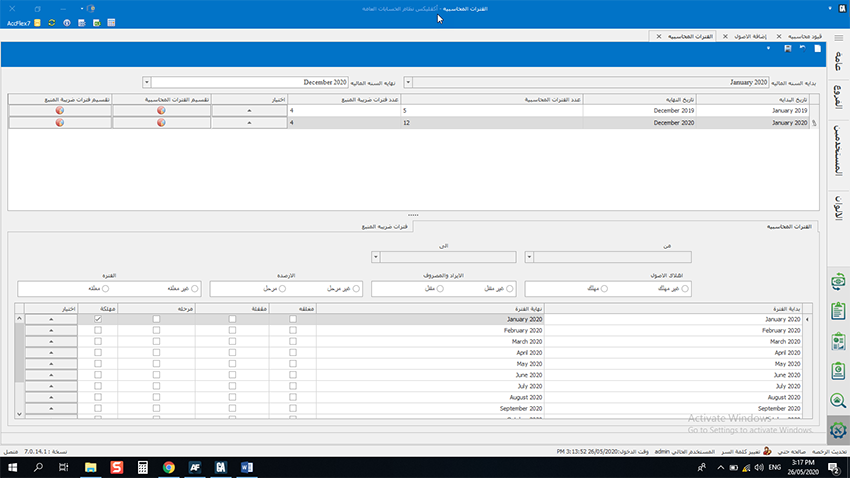

3- Accounting and Tax Periods screen

Through this screen, the accounting periods are divided according to the company's financial policy, the software allows you to divide the fiscal year into (one accounting period- two accounting periods- four accounting periods- twelve-month accounting period) and allows you to control the accounting periods in terms of (closing accounting period- a depreciation of assets for the period- posting period balances- closing income and expenses for the period), and the tax periods for taxes of withholding and collecting are divided into four tax periods (a period every 3 months) as followed and allows you to close them and enter payment data (tax amount- payment date- check number- bank branch- currency) and print tax form 41.

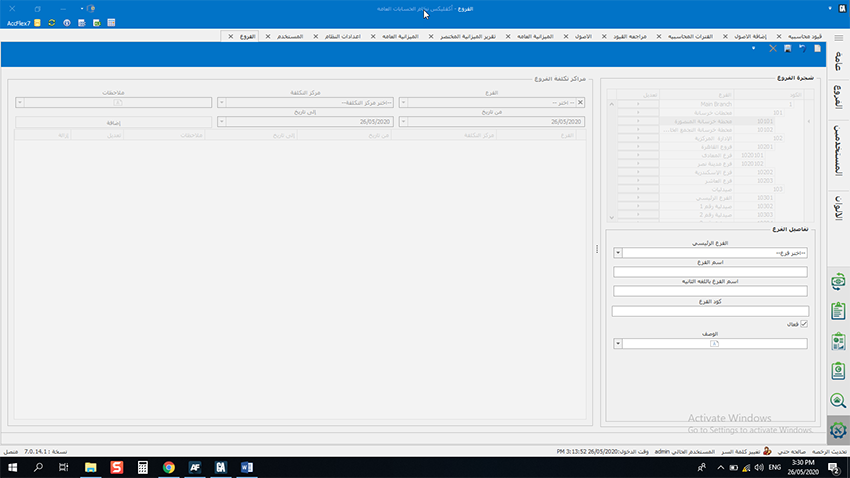

4- Branch screen

Through this screen, an organizational chart is created for the branches of the company, if the company has more than one branch, the headquarters branch and its branch offices are created, the software allows you the ability to create an infinite number of branches and assign each branch to its cost center.

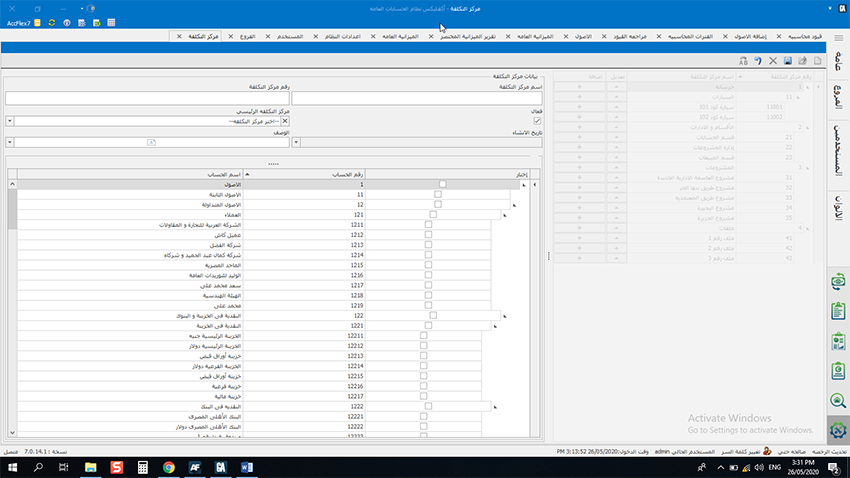

5- Cost Center screen

Through this screen, the cost centers of the company are created in a hierarchy and assigned to branches and accounts related to them, an infinite number of cost centers can be created.

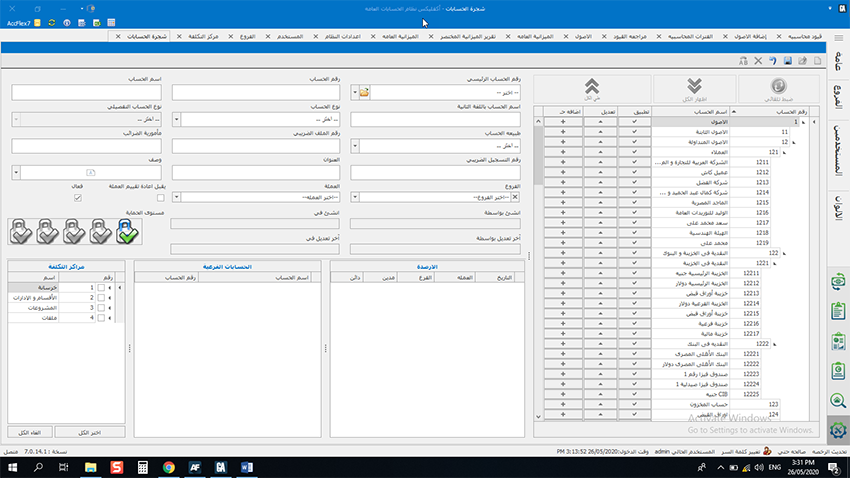

6- Chart of Accounts screen

Through this screen, a company's chart of accounts is created, and a default chart of accounts comes with the software includes typical accounts, and the company can add its accounts, and through this screen is selected (Account Name- Account Number- Nature of Account-...) as well as can create a parent account and its child accounts can be added with the same characteristics and there are many advantages on the Chart of Accounts screen that is distinguished from any other software, an infinite number of accounts can be added as soon as possible and can back the wrong account in the chart of accounts to the correct side as easily as possible, as well as transferring the journal entries from an account to an account and assigning an account to a specific branch or a specific cost center, in addition to the ability to make an account appear on screens only, show the account balance, the debit and credit transactions that were recorded on it, in addition to many other features on the Chart of Accounts screen.

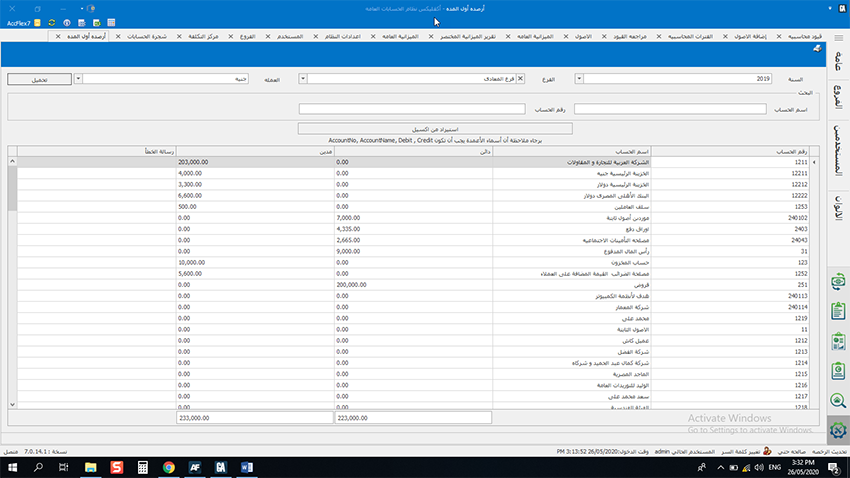

7- Opening Balances screen

Through this screen, the opening balance is entered for each account and allows you to enter the balance of each account separately or enter all account balances in a split second by importing the opening balances from an Excel file.

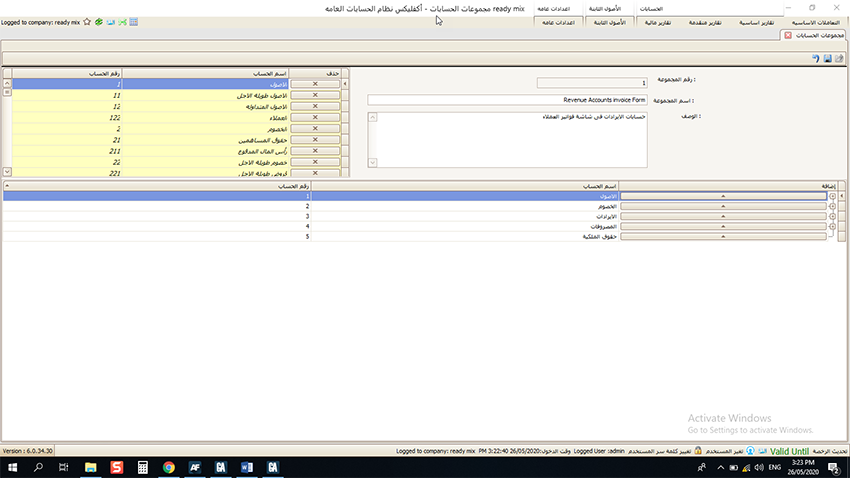

8- Account Groups screen

Through this screen, an infinite number of account groups are created that contribute to increasing the degree of control over the accounts and determining the responsibilities of each accountant in the finance department, it is possible to create (receipt screen- payment screen- treasury screen- bank screen....) and selecting the accounts group that appear on each screen.

Second, Basic Transactions Menu

Through this menu, daily recurring accounting transactions are performed, and this menu is divided into several screens

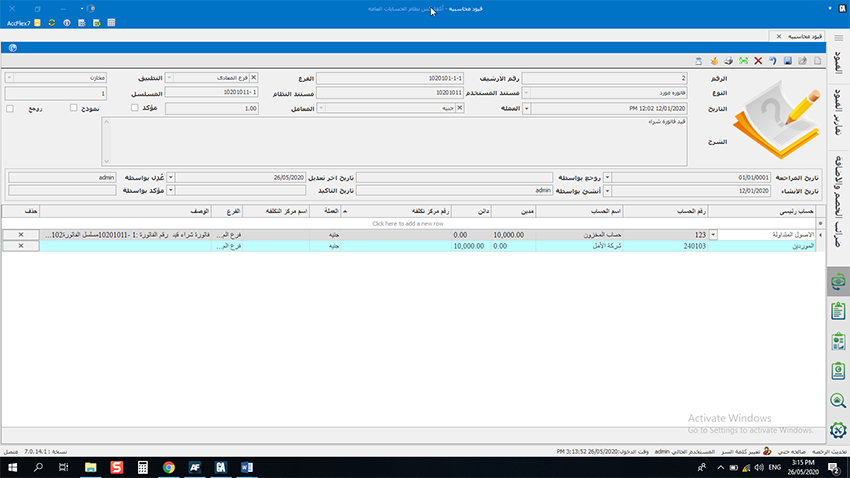

1- Accounting Journal Entries screen

Through the accounting journal entries screen, you can create accounting journal entries and this screen is distinguished by having more than one reference number for one journal entry that facilitates the search for the journal entry in addition to the ability to import the accounting journal entry from an Excel file and add an attachment to a journal entry and when creating a recurring journal entry, the software allows you the ability to create a journal entry template for use later, there are also many advantages in the Accounting Journal Entries screen.

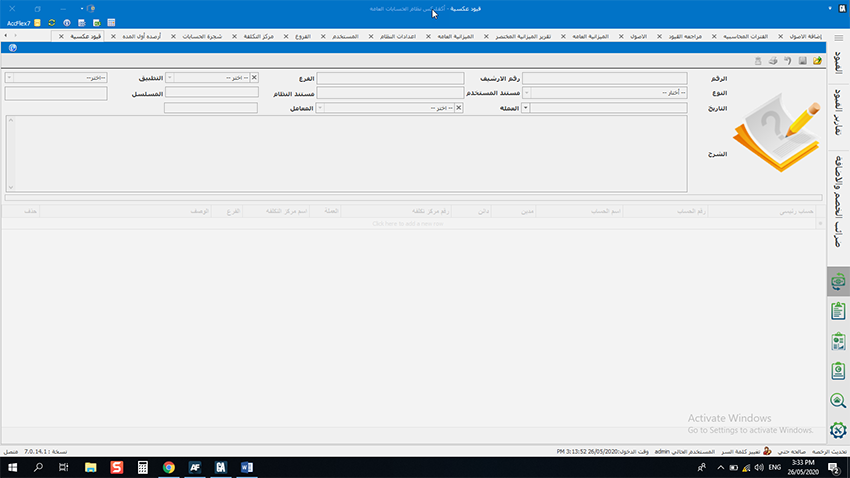

2- Reverse Journal Entries screen

Through this screen, journal entries are deleted once selecting the accounting journal entry to be deleted and click save, the journal entry will be deleted.

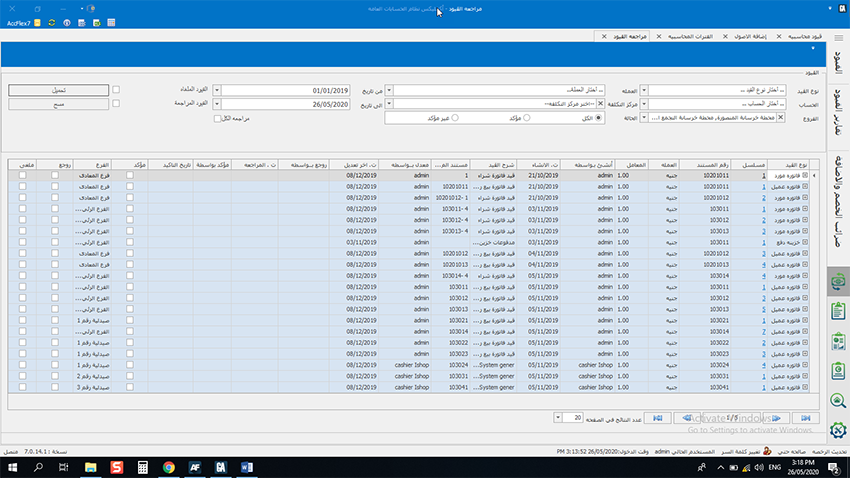

3- Review Journal Entries screen

Through this screen, the journal entries can be reviewed and display them with all their details.

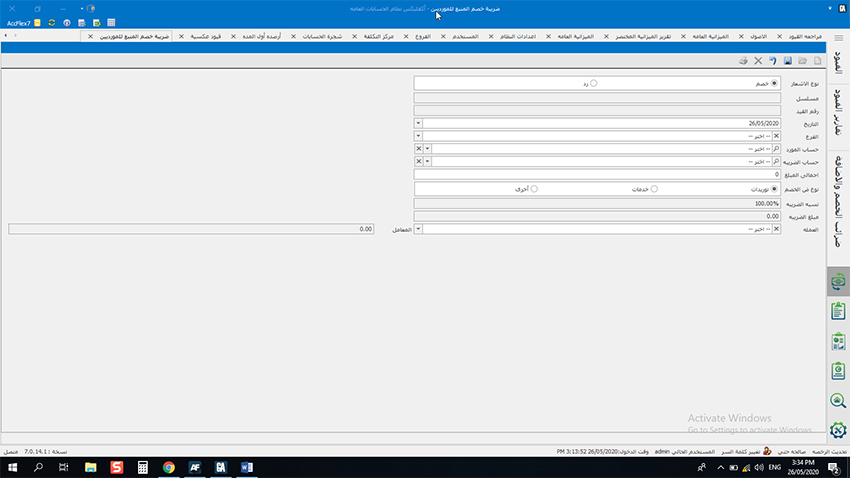

4- Withholding Tax screen (supplier/customer)

Through this screen, debit notes of withholding tax can be created, whether for the supplier or the customer by selecting the invoice and the supplier/customer and the software creates the notification automatically.

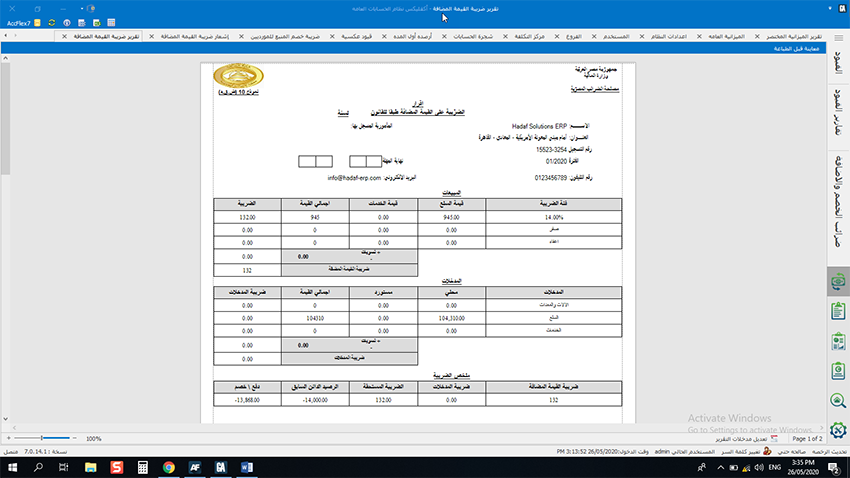

5- VAT Notification screen

Through this screen, a VAT notification is created, once the period in which we want to create the value-added tax is selected, the software automatically calculates the tax and the value-added tax notification will show you the value Added Tax- Form-10 as it is in the Tax Authority.

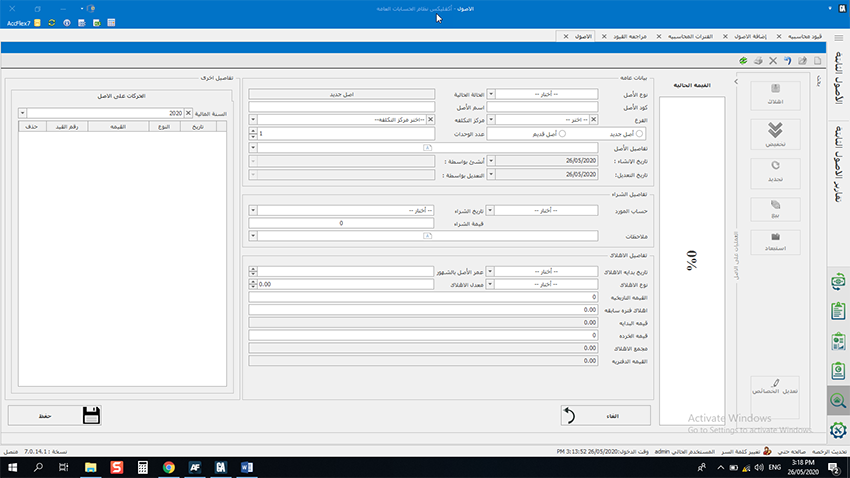

Third, Fixed Assets

It is a fixed assets module through which the company can manage its fixed assets (asset acquisition, entering assets data, and asset retirement, write-off, selling ......) and it is divided into

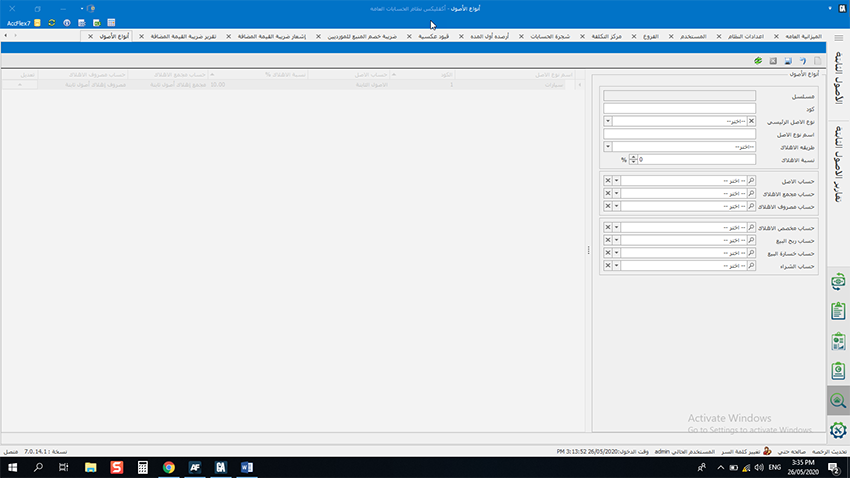

1- Asset Types screen

Through this screen, an infinite number of assets are created in a hierarchy, so asset group of machinery and equipment is added and entering more than one parent asset and child asset under it and selecting the purchase, retirement, and depreciation accounts of each group.

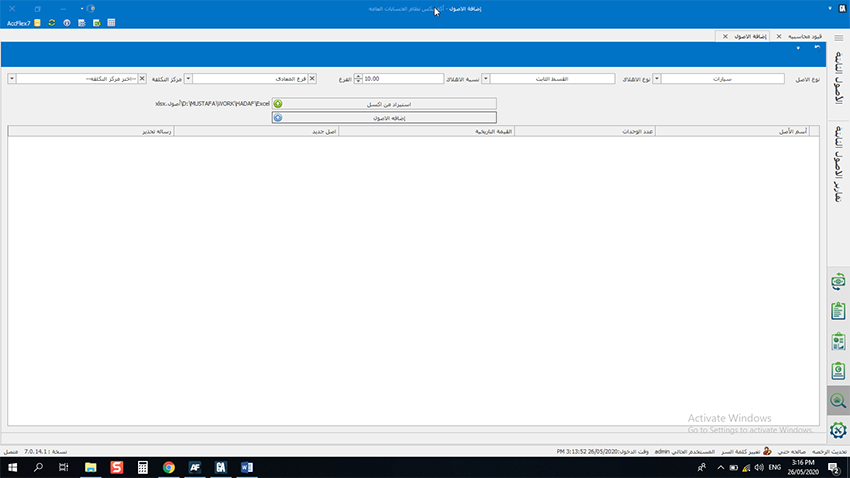

2- Asset Acquisition screen

Through this screen, an infinite number of assets are added in a split second through an Excel file.

3- Asset screen

Through this screen, the asset data is entered and all its properties are selected, selecting whether the asset is new or used, its value and depreciation method, entering the asset documents and determining who is responsible for the custody, and various transactions can be performed for the asset of (depreciation, asset renewal, asset write-off, retirement, selling).