Treasury & Banking System

AccFlex ERP - Best Cash Management Software - Treasury Management Software - Treasury & Banking Software

Accflex Cash Management Program Screens

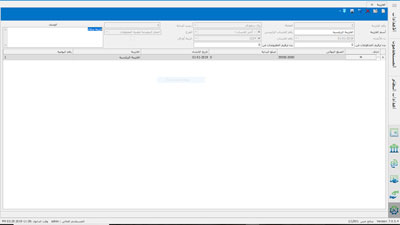

1-Treasury Screen

The treasury screen organizes the collection, payment, and transfer operations that are conducted directly from the company's treasury.

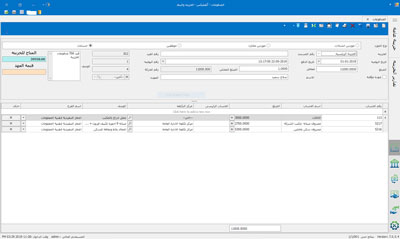

2-Payments Screen

Payment transactions can be created, whether for a specific supplier by selecting the supplier and the invoice to be paid, or for any other account under expense items. The user can also create a payment transaction through the cash advance.

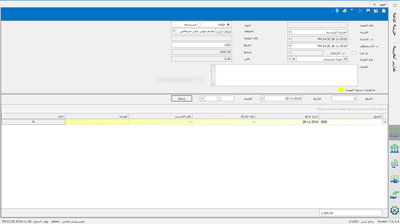

3-Receipts Screen

Receipt and collection transactions can be created, whether from a specific customer by selecting the customer and the invoice to be collected, or from another account under revenue items. It is also possible to collect from multiple sources in the same collection transaction.

4-Advances Screen

The cash management program provides a comprehensive system for creating and settling all types of advances. An advance is created and linked to the receiving employee, then settled with the treasury officer, recording payment transactions through the advance.

Advance payments are documented with supporting documents showing the sources and purposes of the expenditures.

5-Cash Transfer Movements

Through the cash transfer system, users can create a transfer movement from one treasury to another. Receipt confirmation can be made from one treasury to another, from a treasury to a bank, or from one bank to another.

6-Bank Screen

The bank screen is dedicated to documenting collection and payment operations through the company's bank accounts. The program provides complete accounting processing for all stages of the check cycle (receivable documents), from recording their receipt from the client and including them in the company's receivable documents treasury, to their collection from the bank, return, cancellation, or rejection.

7-Payable Documents

Through the payable documents screen, payment movements to suppliers or any expense item are documented by issuing checks from the company. The process of issuing a check to the beneficiary is recorded by entering the check number, amount, beneficiary, type of check, and its due date. The check status is updated whether the check is collected by the beneficiary, reducing the company's bank account balance, or returned and canceled.

8-Receivable Documents

The receivable documents screen operates similarly to the payable documents screen, but collections are made from clients for incoming checks. The movement of the check is tracked by sending it to the bank for collection and recording the collection fee.

9-Bank Transfer Payments Screen

This screen documents direct payment operations through the company's current account at the bank to the beneficiary, as in the case of online payments. Users can record payment operations through bank transfer from the company's account to the beneficiary's account or cash withdrawals from the account.

10-Bank Transfer Receipts System

The bank transfer receipts screen documents the receipts made to the company's accounts by clients, either through direct deposits into the company's account or through bank transfers from the client's bank account to the company's bank account.

Linking Receipts to Client Invoices and Documents

All collection operations in the treasury and banks program, whether made in cash in the treasury or receivable documents in banks, can be linked to documents such as:

- Linking client collections to sales invoices to determine debt ages and unpaid invoices from clients.

- Linking collections from employees, such as returning advances to the treasury, in the human resources system.

- Linking collections related to suppliers due to the return of certain items to purchase invoices.

- Linking collections from owners to issued owner extracts in the contracting program.

- Linking collections related to due installments from sales contracts in the real estate investment program.

- Linking direct collections to a specific account in the chart of accounts through a receipt voucher.

Linking Payments to Invoices and Documents

All payment screens in cash management programs, whether from the treasury or the bank or through payable documents, link payment movements to a specific document such as:

- Linking payments to suppliers to purchase invoices and determining debt ages.

- Linking payments to employees to advance documents previously issued by the human resources department in the employee affairs program.

- Linking payments to clients for returned goods to the sales invoice (return document).

- Linking payments to subcontractors to contractor extracts previously issued in the contracting accounting program.

- Linking direct payments to various expense accounts to previously issued payment vouchers.

Creating a Bank Directory

A bank directory can be created for the banks the institution deals with, including detailed descriptions of the company's account in the bank, the balance, and the bank policy for dealing with the bank account. The bank definition screen includes the following detailed data for the account:

- Bank account name and number.

- Opening balance.

- Currency.

- Bank account in the chart of accounts.

- Receivable and payable documents accounts in the accounting guide.

- Bank expenses account related to check collection, rejection, and other expenses.

Checkbooks and Starting Numbering

Integrated Cycle of Issued and Received Checks

The check cycle starts with receipt from clients or issuing checks to suppliers, and then checks can be tracked through all stages of their collection, whether direct collection through the bank or clearing operations.

- The return or cancellation of a check can be documented for any reason, affecting the client's account statement after the return.

- All bank expenses related to the collection or return of checks can be documented at various stages of the check cycle.

- All stages of the check cycle are translated into daily entries automatically in the general accounts program.

- Detailed reports can be generated to track checks and their collection.

Bank Transfers in the Cash Management Program

These are the disbursement and collection operations that occur in the bank account through online transfer or direct account transactions. The bank transfer receipts and payments screens are used in the following cases:

- Documenting client deposits into the bank account directly from the client or through online transfer.

- Documenting bank payments (bank disbursements) made to bank accounts through online transfer or direct cash withdrawals from the bank account.

- Payment operations to various entities through credit cards.

Employee Advances Management

The treasury and banks program provides a comprehensive system for managing cash advances, including:

- Adding different types of advances (travel advances, purchase advances, expense advances, etc.).

- Printing a receipt for the advance for the receiving employee to sign.

- Settling the advance in different payment accounts.

- Returning all or part of the advance.

- Detailed reports on advances and settled advances.

Cash Transfers Management System

Cash transfers are made between treasuries or between the treasury and the bank or vice versa, as well as transfers from the check treasury to the cash treasury directly. Transfer and receipt operations are based on each user's permissions for the transferred or received treasury.

Key Reports Issued by the Cash Management Program

Detailed and summary reports for cash management and the financial system as a whole. The Akflex accounting programs system provides a range of detailed reports covering all parts of the financial and administrative system as a whole. Examples of reports provided by the program include:

First: Treasury Reports

- Payments and receipts report.

- Treasury statement by date report.

- Treasury daily assistant ledger report.

- Detailed treasury movements report.

- Employee advances report.

- Treasury balances report.

Second: Banking Transactions Reports

- Bank transfer payments report.

- Bank transfer receipts report.

- Receivable documents report.

- Payable documents report.

- Bank account statement report.

- Bank balances report.

Guarantee Letters Management

A special section for managing guarantee letters is one of the program's unique features. Through this section, guarantee letters can be created, specifying the issuing bank, the client's name (construction client, warehouse client, tourism client, real estate marketing clients, etc.), bank commission, coverage ratio if there is a facilitation agreement with the bank, guarantee letter type (preliminary, final, advance payment), and the cost center for the guarantee letter. The program also allows changing the status of the guarantee letter (increasing, decreasing, extending, terminating, liquidating), and viewing the historical status and changes made to the guarantee letter. The program automatically creates all guarantee letter entries.

Guarantee Letters Reports

The cash management program features a set of reports covering all necessary information about guarantee letter management (guarantee letter number, expiration date, issuance date, value, bank commission, coverage ratio, client, type, bank, cost center, etc.) and changes made to the guarantee letter (suspension, cancellation, liquidation, extension, termination).

How could using cash management software helps your business

Automatic Reminder of Receivable and Payable Documents Upon Opening the Cash Management Program

One of the outstanding reports that assists the financial management in managing the company's cash and obligations. As soon as the cash management program is opened, checks payable to suppliers and contractors (payable documents) and checks receivable from clients (receivable documents) are displayed, helping the company manage its treasury and bank, as well as collection activities and cash management.

Printing Checks from the Treasury and Banks Program

One of the key features of the treasury and banks management program is that all operations and procedures necessary for managing the treasury and banks are handled through a single program without the need for additional tools. Through the program, you can enter checkbook serial numbers and design the check in the same format as the bank’s checkbook, allowing you to print the check directly from the program.

Invoice Adjustment Screen

An additional feature that distinguishes the program is the presence of a screen where paid supplier invoices can be linked. You can select a supplier invoice and associate it with the payment amount, making it difficult to duplicate the payment for the same invoice. The program matches the payment or due amount with the supplier's or client's invoice.

Updating Treasury Balance and Displaying It When Creating Payment Transactions

A distinguishing feature of the treasury in the program is that its balances are constantly displayed and automatically updated by the program as soon as any payment transaction is created. During the daily operations of the treasurer, it may be difficult to inventory the treasury after each transaction, which could affect business continuity and lead to errors, necessitating work stoppages during cash counting. However, the Akflex treasury and banks management program allows you to know the treasury balance when creating each transaction to determine if there is enough cash to execute payment orders, thus preventing any errors in the treasury balance.

Entering All Treasury Transactions from an Excel File

The program is characterized by its flexibility and simplicity, allowing the entry of an unlimited number of treasury transactions (receipt screen - payment screen) by importing the transactions from an Excel file. In a fraction of a second, the impact of these transactions appears in the account tree.

The Program Automatically Creates All Treasury and Bank Entries

If you own the Akflex treasury and banks management program, you won’t have to worry, as the program will automatically create accounting entries for all treasury and bank transactions without the need for manual entry. The program also automatically affects the account tree and financial statements.

Entering All Bank Transactions from an Excel File

The Akflex treasury and banks management program is characterized by its flexibility and simplicity, allowing the entry of an unlimited number of bank transactions (receivable documents screen - payable documents screen) by importing the transactions from an Excel file. In a fraction of a second, the impact of these transactions appears in the account tree.

Receivables and Payables

The program is specialized in processing cash and bank movements and tracking collection and payment operations, whether in cash or through receivable documents and checks. The treasury and banks program operates in an integrated and interconnected manner with the inventory management, general accounts, human resources, contracting, and real estate marketing programs. All collection and payment operations are translated into daily entries that are recorded in the general accounts program.

Coding in the Treasury and Banks Program

The main and subsidiary treasuries can be created according to the work requirements and the size of the institution. Treasury accounts can be linked to the accounting guide in the general accounts program to control the accounting directives related to the treasury. The treasury description screen includes the following detailed data:

- Treasury name.

- Opening balance.

- Branch.

- Treasury account in the chart of accounts.

- Creation date.

The same steps are followed to create banks within the program.

Benefits of cash management software?

- The program encodes banks, safes, and methods and types of payment, linking them to general accounts.

- The movement of cash within the company, including payment and receipt vouchers, is recorded in the program, which automatically processes them, issues the relevant accounting entries, and transfers them to the general accounts.

- It allows for treasury management and tracking its movements through receipt and payment vouchers, where an accounting entry is automatically created.

- It can display all transactions that have occurred in the treasury, with different account numbers, showing them as a cash flow statement within the window accounting program.

- It can track all receipt and payment voucher movements and their effects on the treasury in the window accounting program.

- The program monitors receivable documents from receipt to full payment, as well as payable documents from issuance to full payment, and tracks their bank accounts in the window accounting program.

- The program compares bank statements with the transactions entered according to the user's view.

- It allows monitoring of each bank's withdrawal and deposit movements and provides a detailed statement showing these banks' balances.

- It can review all transactions carried out on the banks through the program and issue a statement from the program to match with the bank's statement (bank reconciliation).

- The program automatically issues regulatory entries and transfers them to the general accounts.

- The accounting program tracks the movement of checks and promissory notes from receipt, dispatch, and export to the bank.

- Full monitoring of payment and receipt records in the window accounting program.

- An advanced user permissions system for saving, editing, deleting, and printing operations for each transaction.