What is the accounting treatment for bank of warrantee letters, and how can we apply it to the contracting company accounting program Accflex?

What are the restrictions for issuing a bank of warrantee letters? What are the security services for bank warrantee services?

How can the reduction in bank of warrantee letters be proved?

And what means the Liquefaction speech?

Conditional bank of warrantee letters

We spoke in a previous article about the issue of the warrantee course in the contracting company accounting program

Through our article, we will know about an integrated course for all cases that obtain bank warrantee through the daily restrictions...

Meaning of warrantee letters in contracting companies

warrantee letters Bank are a method used by companies, especially contracting companies, and it is a letter presented by the contracting company to the owner to ensure that they will carry out their work to the fullest extent and if it happens that the contracting company did not implement the required of it, the project owner has the right to go to the bank and withdraw money from the warrantee letters as compensation for him

As a result of the damage occurring because the contractor did not comply with what is required of him

What are the accounting treatment of letters of guarantee and how it can be applied by the contracting companies accounting software?

To identify the accounting treatment for letters of guarantee and how we apply to the contracting companies accounting program through warrantee letters cycle as follow

The first case, the issuance of warrantee letters

In accordance with an agreement or a bank facility contract with the bank, all in the currency, we go to the bank that we deal with and say that we want to present a bank warrantee letters that we present to our customer, so the bank informs you of the letter and according to the agreement between you, the bank issues the warrantee letters, and in return takes a commission, And the issuance expenses, and the bank often does not include us with the full value of the letters of guarantee, but it allows us to cover part of the letter of guarantee that we want to go out, meaning in a more correct sense if we want a bank letter of guarantee, for example with one million pounds, here the bank includes us with 900 thousand but and the rest are 100 thousand held by our account, of the 100 thousand, and we call them the cover of the warrantee letters, and they are considered assets we have, to the extent that the letter expires and returns us to the next account

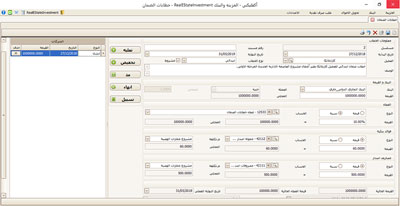

This explains how the warrantee letters is issued in the receipts and payments program, as an integral part of the contracting companies accounting program Accflex

The entry resulting from the issuance of bank warrantee letters

The second case: raising bank warrantee letters in contracting accounting programs

What do raising bank warrantee letters mean?

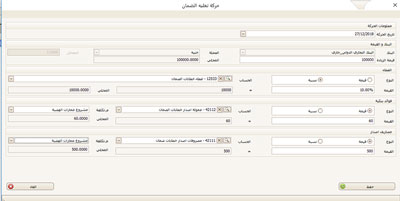

Raising warrantee letters simply means that the owner needs to provide the value of the warrantee letters for any reason, for example that it is expanding in the work and therefore the contractual value has increased, and from here we need, accordingly, to increase or increase the value of the letter, and if we will apply this to the contracting accounting program Accflex system, we can see the elevation screen from here

And of course, this entry resulting from raising the warrantee letters in the public accounts program

The third case: Reducing bank warrantee letters

In contrast to the previous case here, the value of the warrantee letters is reduced for any reason, for example it is possible that the date of the warrantee letters has expired, but the owner needs to extend the period of the letter with a reduction in its value or that in a new contractual relation that resulted in a reduction in the value of old contracts, thus reducing the value of warrantee letters.

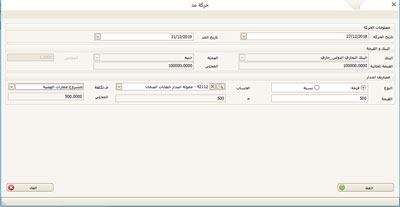

This is the form of the screen for reducing the value of bank warrantee letters in the contracting accounting system

This is a general form of the restriction resulting from the process of reducing the warrantee letters in the contracting company accounting program Accflex

Fourth case: Extending bank warrantee letters

What is meant here is that the owner agrees with us as a contracting company that we extend the period of the letter of guarantee and this process will not have any accounting effect unless the bank takes interest or commission from us as a result of extending the warrantee letters

A picture of the extending bank warrantee letters screen from the cash monitoring program within the Accflex contracting accounting program

The journal entry in the general accounts program

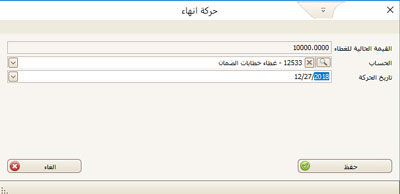

The fifth case: ending of bank warrantee letters

Here, when the period of the warrantee letters ends, and the bank returns the value of the cover to our account, we start confirming this transaction on the system in this way

This restriction resulting from the ending of the warrantee letters

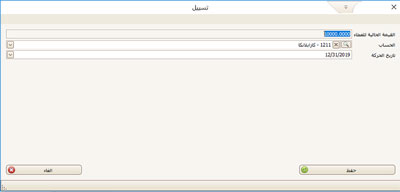

The fifth and final case: the liquefaction of bank letters of guarantee

This is a difficult case to happen but it is contained. What is meant by bank letters of guarantee is that my client is a gold contracting company for the bank and demanded the value of the letter of guarantee because I, as a contracting company, did not abide by the terms of the contract between us and therefore according to the contract the customer went to the bank and took the value of the letter, and therefore here is accounting. I have a liability as a result of the bank paying the portion of what was my warrantor

Do you remember when we said that the value of the letter is one million pounds, and the bank will contribute 900 to include it, and I will contribute 100,000 as a cover for the letter.

Contracting companies accounting program

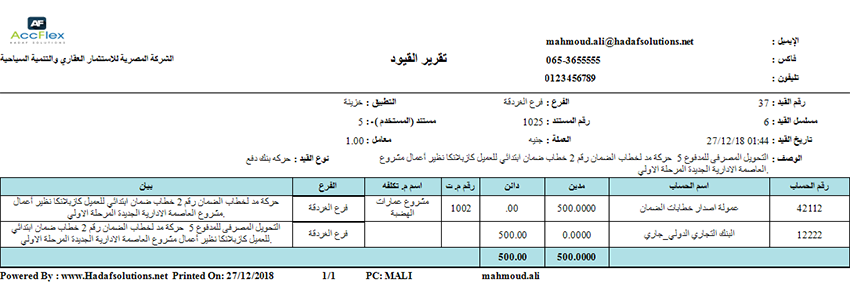

This is the constraint resulting from it

Thus, we will study the bank guarantee

restrictions through the cases that can be carried out, with the application to

the Accflex contracting accounting software