Tourism is one of the most important national income sources for many countries because it provides foreign currency for the country that is most attractive to tourists. In 2019, the number of tourists worldwide reached 1.5 billion, and the tourism forms vary, there are (religious, archaeological, recreational, therapeutic, discovery, etc.) tourism, and what a large number of tourists need services (hotel reservations, flight reservations, rental car, recreational trips, transfers, sightseeing) that the tourist cannot do it himself, there must have been a large number of tourism companies specializing in one or more of these services that can be provided to tourists, in Egypt alone, there were approximately 19,000 tourism companies that perform a range of services between (hotel reservations, airline tickets reservations, organizing internal trips, Hajj and Umrah services, religious tourism, etc.), the Egyptian tourism companies are divided into three categories, which is the (a) category, which is a general activity tourism company that provides Hajj and Umrah services and domestic and foreign tourism, and the (B) category tourism company, which provides the tourist transport services and the (C) category tourism company, which is a tourism company is responsible only for providing services as an agent for the major companies and we cannot ignore the domestic tourism, so the role of tourism companies is not limited to providing services to foreign tourists, but it may be related to providing tourism and recreational services to residents as well, and with this large number of tourism companies in addition to the other parties related to tourism and travel activities such as travel agents and the International Air Transport Association (IATA), it was necessary to design an accounting system that is appropriate to the nature of the activity and organize the financial and accounting matters for the various travel and tourism companies in its various categories (A - B - C ...).

Definition of the accounting system for Travel Agencies

Before we define the accounting system of the tourism and travel companies, we must first know what is accounting? Accounting is defined as the science that records and sorts the financial transactions data according to a specific system to translate these data into financial information (reports) that show the financial position of the company (the organization), the results of its business of profits or losses and provide this information (reports) to internal parties (senior management- corporate departments - partners - shareholders ....) and the external parties (bank- suppliers- customers- Tax Authority-.....) these reports include (Trial Balance- General Ledger- Subsidiary Ledger- Account Balance....) as well as the financial statements such as (Financial Position- Balance Sheet- Income Statement- Cash Flow Statement- Statement of Changes in Equity ...).

It cannot be said that the accounting system of travel and tourism companies differs from the accounting system of any other company, as most of the parent accounts are common, but there may be some differences that distinguish the travel and tourism companies from other companies, travel and tourism activity are divided into two parts

Part 1: Tourism/ which are all about hotel reservations, restaurants, transportation, and recreational trips to the tourist in the country he is visiting, and of course these operations result in expenses and revenues, these reservations may be prepaid or maybe later and the accounting treatment for each case is separately and usually in the tourism companies, such procedures are performed between the tourism company and a travel agent on behalf of the hotel to be booked

Part 2: Travel / is all about airline ticket reservations for the tourist to the country which he wants to travel, and the procedures that follow such as (date change- ticket cancellation- postponing travel- ticket refund - etc.) the expenses and revenues that result from these operations may be cash or maybe credit, the accounting treatment is done for all airline ticket reservations, and the tourism company does not book directly on the airline website (Saudi Arabian Airlines- EgyptAir- Emirates Airline....) but there is a global travel agent website that all tourism companies deal through which is "International Air Transport Association" abbreviated as "IATA", this website is considered as a travel agent between the tourism company and the airline and is the only credit account in travel cases as the airline pays for the International Air Transport Association twice a month on 15 and 31 days at the end of each month for the total value of the travel tickets due.

Revenues and Expenses of Travel Agencies

The revenues of travel and tourism companies vary according to the size of the tourism company, for example, the (C) category tourism companies, their revenues are in commissions resulting from the difference between the service sales revenue and the cost of service, whereas the revenues of the (A) category large travel and tourism company vary as follows:

1- The commission of hotel reservations resulting from the difference between hotel reservation revenues and the cost of the reservation.

2- The commission of airline ticket reservations about the difference between airline ticket revenues and the cost of the reservation.

3- Revenues from domestic and international tourism (archaeological tourism- religious tourism- performance of the Hajj and Umrah rituals- domestic tourism - recreational tours - car rental - bus revenues - other revenues ... ).

The Tourism Company issues invoices with its benefits, which include forms known as operating orders (a form that explains operating process data) and shows the following data:

(Driver's name- operating hour- operation date- operation order number- number of tourists- customer name- the name of the supervisor/ tour guide- car data- .....), then operating orders are collected related to each destination separately (a specific hotel- a specific restaurant- a specific Nile steamer- ....), an invoice is issued with the total value of the operating orders indicating the same operating order data added to it (the name of the destination to which the invoice is directed- invoice amount- value-added tax value- payment period....) and it may be done collecting the value of this invoice in cash once the operation order is completed or a credit collection according to the agreement with the party to collect the invoices from them, and all operating orders are recorded monthly in what is called a " movement journal" that differs from the subsidiary ledger for revenue, which contains an analysis of the types of revenues of the tourism company and the value of each income and percentage of each activity from the company's total revenue.

As for travel and tourism companies expenses, they vary between activity costs and general and administrative expense

A - Activity costs and include

1- Booked airline ticket costs that are paid through the IATA website.

2- Hotel booking costs which are paid to travel agents.

3- The costs of tourism trips (religious- archaeological- recreational- domestic- Hajj and Umrah ...).

4- The costs of the various tourism transportation (buses- cars- trucks-...) of drivers' wages, fuel, oils, spare parts, licenses fees, transit fees, etc.

5- Wages and salaries of supervisors, tour guides, and accompanying tourist groups.

6- Commissions of agents and marketers of tourism companies.

7- The costs of meals, clothing, and benefits in kind for employees or tourist groups.

B - General and Administrative (G&A) Expenses:

These are the expenses related to the salaries of the administration staff, the administrative and financial system of the company, as well as the rent of the company's headquarters, warehouses, utilities expenses, stationery, paper, printing inks, advertising expenses, marketing expenses, annual subscriptions of the website and others.

All revenues and expenses for the travel and tourism companies are recorded and classified in the chart of accounts to get the accounting reports that show the value of the company’s profits or losses during the fiscal year, to know how to record and classify revenues and expenses, it is first necessary to identify the chart of accounts for the travel and tourism company.

Chart of Accounts for a Travel Agency

The chart of accounts is similar for all companies; the basis of the chart of accounts is the presence of the parent accounts (assets- liabilities- equity- revenue- expense), each account is branched from a group of child accounts that may differ from one company to another, but the general layout of the chart of accounts remains the same, and the travel and tourism company chart of accounts can be displayed are as follows:

|

1 |

Fixed Assets |

||

|

1.1 |

Buildings |

||

|

1.1.1 |

Administrative Headquarter |

||

|

1.1.2 |

Spare parts Warehouse Building |

||

|

1.2 |

Vehicles |

||

|

1.2.1 |

Tourist Buses |

||

|

1.2.2 |

Cars |

||

|

1.3 |

Computer Equipment |

||

|

1.4 |

Furniture and Fixtures |

||

|

1.4.1 |

Reservation Desks |

||

|

1.4.2 |

Conference Room |

||

|

2 |

Current Assets |

||

|

2.1 |

Cash on Hand |

||

|

2.1.1 |

Main Treasury |

||

|

2.1.2 |

Hurghada Branch Treasury |

||

|

2.2 |

Bank |

||

|

2.2.1 |

Banque Misr |

||

|

2.2.2 |

National Bank of Kuwait (NBK) |

||

|

2.3 |

Accounts Receivable |

||

|

2.3.1 |

Tourism Transportation Customers |

||

|

2.3.2 |

Domestic Tourism Customers |

||

|

2.3.3 |

Hajj and Umrah Customers |

||

|

2.4 |

Petty Cash |

||

|

2.4.1 |

Petty Cash - Supervisors |

||

|

2.4.2 |

Petty Cash - Tour Guides |

||

|

2.5 |

Inventory |

||

|

2.5.1 |

Auto Parts Warehouse |

||

|

2.5.2 |

Clothing and Gift Warehouse |

||

|

2.6 |

Notes Receivable |

||

|

2.7 |

Prepaid Expenses |

||

|

2.8 |

Accrued Revenue |

|

3 |

Current Liabilities |

||

|

3.1 |

Creditors |

||

|

3.1.1 |

IATA |

||

|

3.1.2 |

Travel Agents |

||

|

3.2 |

Accounts Payable |

||

|

3.2.1 |

Suppliers - Food |

||

|

3.2.2 |

Suppliers - Clothing |

||

|

3.3 |

Notes Payable |

||

|

3.4 |

Short-term loans |

||

|

3.5 |

Provisions |

||

|

3.5.1 |

Depreciation Allowance |

||

|

3.5.2 |

Allowance for doubtful Account |

||

|

3.6 |

Other Credit Balances |

||

|

3.6.1 |

Tax Authority |

||

|

3.6.2 |

Social Insurance |

||

|

4 |

Long-term Liabilities |

||

|

4.1 |

Long-term loans |

||

|

5 |

Equity |

||

|

5.1 |

Capital |

||

|

5.2 |

Retained Earnings |

||

|

5.3 |

Reserves |

||

|

5.4 |

Partner's Current Account |

|

6 |

Expenses |

||

|

6.1 |

Operating Expenses |

||

|

6.1.1 |

Airline Ticket Costs |

||

|

6.1.2 |

Hotel Reservations Costs |

||

|

6.1.3 |

Tour Costs |

||

|

6.1.4 |

Meal and Gift Costs |

||

|

6.2 |

General And Administrative Expenses |

||

|

6.2.1 |

Wages and Salaries |

||

|

6.2.2 |

Rent of the company headquarters |

||

|

6.2.3 |

Depreciation Expense |

||

|

6.2.4 |

Website fees and subscriptions |

||

|

6.2.5 |

Utilities |

||

|

6.3 |

Sales and Marketing Expenses |

||

|

6.3.1 |

Sellers and marketers commissions |

||

|

6.3.2 |

Advertising printing and marketing |

||

|

7 |

Revenue |

||

|

7.1 |

Activity Revenues |

||

|

7.1.1 |

Airline Ticket Revenues |

||

|

7.1.2 |

Hotel Booking Revenues |

||

|

7.1.3 |

Domestic Tourism Revenues |

||

|

7.1.4 |

Hajj and Umrah Revenues |

After we have covered the accounting system in the travel and tourism companies and we have covered the chart of accounts the following, we will discuss the journal entries for the most important operations of travel and tourism companies.

Journal Entries for Travel Agencies

Journal entries for travel and tourism companies are not different from journal entries for any company, the accounting treatment is the same, but the tourism and travel companies have some of their terms

1- Revenue Journal Entries

The revenues of tourism and travel companies vary, for example

A -The case of the sale of airline tickets the journal entry is as follows:

|

Account |

Debit |

Credit |

|

Ticket Cost |

XXXX |

|

|

Accounts Receivable |

XXXX |

|

|

Ticket Sales |

XXXX |

|

|

BSP Payable |

XXXX |

Note that the (Account Payable) account is only one account, BSP Payable

This is because the tourism company does not deal directly with the airline, but there is a global travel agent website, "IATA", that considers this site as an agent between all tourism companies deal with it, and it is

Tourism and airline, as we note that the tourism company is just a mediator in the performance of the service, as its revenues from sales of airline tickets are just the commission that you get from the customer and it is the difference between the cost of the airline ticket and the revenue from ticket sales to the customer.

The sale of these tickets may also be a credit or a cash sale and the account receivable collection journal entry is as follows:

|

Account |

Debit |

Credit |

|

Cash on Hand/ Bank |

XXXX |

|

|

Accounts Receivable |

XXXX |

While the tourism company pays the International Air Transport Association (IATA)

Twice a month, on the 15th and on the 31st of the end of each month, by the total value of the travel tickets due,

Accounts payable journal entry is as follows:

|

Account |

Debit |

Credit |

|

BSP Payable |

XXXX |

|

|

Cash on Hand/ Bank |

XXXX |

Ticket Refunding Cases

The process of refunding tickets is done according to the policies and procedures regulated by each airline, therefore, the refund time may vary from one company to another, and the journal entry for refunding tickets is as follows:

|

Account |

Debit |

Credit |

|

Ticket Sales |

XXXX |

|

|

BSP Payable |

XXXX |

|

|

Ticket Cost |

XXXX |

|

|

Accounts Receivable - Refund Ticket |

XXXX |

We note that we have created a journal entry by reversing the side of accrual to cancel the accounting effect for it, and when to refund the ticket value to the customer we must note that there are airlines that refund the value of tickets at the same time and there are companies that take some time to agree to refund the ticket, and therefore clearing account is created it is called (the refund ticket) and accrual is creating for it, and upon payment, the account of the refund ticket is closed by the journal entry

|

Account |

Debit |

Credit |

|

Refund Ticket |

XXXX |

|

|

Cash on Hand/ Bank |

XXXX |

B- The case of sale of hotels reservations

the tourism company does not directly deal with hotels while booking hotels for customers, but it is usually a travel agent who will make the reservation and the tourism company be paid the travel agent, there is more than one travel agent that the company can deal with and the journal entry is as follows:

|

Account |

Debit |

Credit |

|

Hotel Cost |

XXXX |

|

|

Accounts Receivable |

XXXX |

|

|

Hotel Sales |

XXXX |

|

|

Travel Agent Name |

XXXX |

When Paying to the travel agent, the journal entry is as follows:

|

Account |

Debit |

Credit |

|

Travel Agent Name |

XXXX |

|

|

Cash on Hand/ Bank |

XXXX |

C. Tourism Transportation Revenues Mostly

the tourism companies often own a tourism transportation fleet that transports tourist groups within the country to be visited, and the tourism company may rent tourist buses to another company or office and payment may be cash or credit

|

Account |

Debit |

Credit |

|

Accounts Receivable - Tourism Transportation |

XXXX |

|

|

Tourism Transportation Revenues |

XXXX |

When Paying

|

Account |

Debit |

Credit |

|

Cash on Hand/ Bank |

XXXX |

|

|

Accounts Receivable - Tourism Transportation |

XXXX |

D- Other Tourism Revenues

There are many other revenues for tourism companies, which are (domestic tourism revenues- revenues from Hajj and Umrah trips- revenues from archaeological tourism- revenues from recreational tourism .... and others) which may be in contracts between the tourism company and a tourist marketing company and the payment is (credit), or the deal with the customer may be direct, and in most cases, the payment is in cash or prepaid, and the journal entries will be as follows:

|

Account |

Debit |

Credit |

|

Accounts Receivable - Tourism |

XXXX |

|

|

Tourism Revenues |

XXXX |

When Paying

|

Account |

Debit |

Credit |

|

Cash on Hand/ Bank |

XXXX |

|

|

Accounts Receivable - Tourism |

XXXX |

2- Expense Journal Entries

The expense journal entries for tourism companies do not differ from other journal entries; there are costs (operational- marketing- general and administrative...), in most of recording the costs to the travel and tourism company depend on the so-called (operating), which is a form that shows all the details of the activity performed by the tourism company and the tourist group data, bus number, service, and all of its data, through this form, the service revenues, and expenses can be linked.

Expense Journal Entries

|

Account |

Debit |

Credit |

|

Operating Expenses |

XXXX |

|

|

Ticket Cost |

XXXX |

|

|

Hotel Cost |

XXXX |

|

|

Tour Cost |

XXXX |

|

|

Meal & Gift Cost |

XXXX |

|

|

Marketing Expenses |

XXXX |

|

|

Marketing Commission |

XXXX |

|

|

Advertising Expense |

XXXX |

|

|

General and Administrative Expenses |

XXXX |

|

|

Wages and Salaries Expense |

XXXX |

|

|

Fees & Subscriptions |

XXXX |

|

|

Printing & Stationery |

XXXX |

|

|

Cash on Hand/ Bank |

XXXX |

Accounting Software for Travel Agencies

The activities of the tourism companies vary, as there are (religious tourism, Hajj and Umrah, archeological tourism, recreational tourism, airline reservations, etc.) this means that there are many revenues, many expenses, and costs required to complete these activities, this makes it difficult to manage all these activities by relying on traditional paper-based systems, whether in general ledger management, fixed assets, or human resources, as well as hotel reservations, flights, etc. the tourism companies should rely on the accounting software to manage their activities and one of the best unique accounting software for the travel agencies is AccFlex ERP General Ledger Software, the best Arabic software for managing travel and tourism company general ledger accounts at all, the software has many customers (tourism and travel companies) in Egypt and the Middle East, and AccFlex ERP General Ledger Software is characterized by the following

1- Managing accounting periods for the travel and tourism companies with full flexibility, the accounting periods can be divided into a number (1-4-12) accounting period and closing each period separately, as well as managing revenue and expenses for each accounting period, the deprecation of its assets and posting its balances.

2- A flexible chart of accounts through which you can create an infinite number of parent/child accounts and change the order of accounts, as well as transfer journal entries from one account to another account.

3- Creating an infinite number of custom screens in the cash management, you can create a screen for receipts and another for payments, Airline Revenue screen, Tourism Bookings screen, etc., and assign the authorizations for each user in the software (add- edit- delete- print ... ) also, setting the user authorizations to access on screens only.

4- Creating an infinite number of customers and suppliers and set their opening balance.

5- Creating an infinite number of cost centers and branches for the travel and tourism company and assign them to the accounts.

6- A screen for foreign currency revaluation and the ability of the software to deal with more than one currency, the value of the currency can be updated at any time and the software automatically affects the values and accounts.

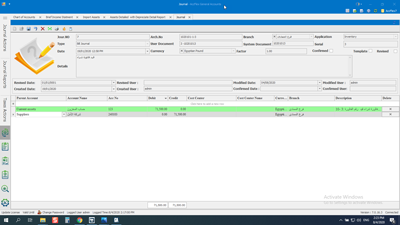

7- The unique screen for entering journal entries enables an infinite number of journal entries to be entered, whether by creating the journal entry or by importing the journal entry data from an Excel file, and adding attachments to the journal entry, the software is characterized by a unique set of warning and alert messages that prevent an error when creating journal entries.

8- A complete system of review and approve journal entries processes through which the chief accountant or financial manager can view the details of each journal entry, user name, data, type of journal entry, date, value, and sides (debit/credit).

9-An integrated tax system starting from linking customers and suppliers with their tax data (Tax Registration Number- Taxation Department Name- Tax ID Number....) and ending with creating the tax notifications of Withholding Tax for the customers and suppliers as well as preparing Form no (41 Withholding and Collection) every 3 months as well as the Value Added Tax - Form-10 every month.

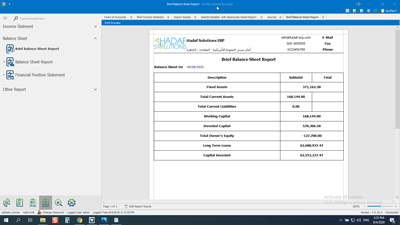

10- A unique set of reports covering all the needs of the tourism company of information on financial statements, whether (General Ledger- Subsidiary Ledger- Subsidiary Ledger for Cost Centers- Subsidiary Ledger for Accounts/ Cost Centers- Accounts Receivable/ Payable Balances Report- Revenue and Expense Summary Report- American General Journal Report- Budget Report- Trial Balance Report- Income Statement Reports- Balance Sheet Report- Financial Position Report- Cash Flow Report- Changes in Equity Report).

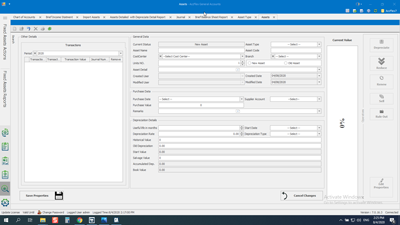

11- A Fixed Asset Management Module comes with the General Ledger Software, which distinguishes the software from other software in which the Fixed Asset Management Software as another software separate from the General Ledger Software, and through the Fixed Asset Management Module, the travel and tourism company can manage the tourism transportation fleet through the Adding an Asset screen by entering the asset data (asset name, type of asset, its value, the method of depreciation, the employee responsible for the asset, cost center ....) also, the location of the asset can be changed from one location to another and the software automatically allocates the costs to the cost centers.

12- Adding an infinite number of assets in a split second using an Excel file, as the software supports the feature of importing from Excel.

13- Creating various transactions on the assets such as (appreciation, depreciation, write-off, scrapping, selling, etc.) and the software automatically creates fixed assets journal entries and affecting the chart of accounts.

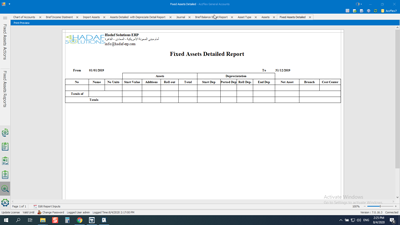

14- The software provides unique reports on the assets, which the travel and tourism companies can track and monitor the assets status as well as controls their costs, there are reports on (Asset Additions- Depreciation of Assets- Types of Assets- Book Value of Assets- Sold Assets- Written off Assets- Scrap Assets- Method of Asset Depreciation- Asset Subsidiary Ledger- Asset List By Cost Center- Asset Status History).