We will talk to you in detail about the implementation of the production orders system in hospitals and medical complexes

Hospital activity is a service and accounting activity that mainly involves two parts

A friendly financial part related to the medical services provided to patients in exchange for a fee, such as medical statements, analyzes, x-rays, and care services and thus this type of services takes the regular accounting cycle in any service activity and the revenue of the services performed is recognized by an accounting entry, such as any sales operation

10,000 from the account / customer

5,000 to the income account, medical statements and consultations.

5,000 to the account of the revenue of CT (X- ray) and resonance rays..

It is a cost-related part that is mainly related to the surgical operations that the hospital offers in the light of its capabilities, and it is assumed that I will have a comprehensive inventory of all types of surgeries that the hospital can perform and coded in a specific way in preparation for making operating orders based on the type of operation presented.

How do I apply production orders to surgical operations?

To better understand the cycle we will need to implement it with constraints

When purchasing raw materials, "medical supplies, such as medicines, blood bags, and various tools"

10,000 EGP from the consumables inventory account

10,000 EGP from the medicaments stock account

50,000 from the medical supplies stock account

250,000 EGP to the supplier's account

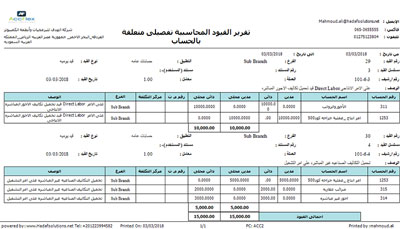

entries purchase of raw materials in the warehouse management program

Until now, this did not cost me anything, as I bought a stock of my tools that I use to practice my activity.

The actual cost cycle begins with the presence of an operating order that "means the start of the surgery."

When dispensing tools and medicines to the patient's surgical procedure

10,000 from account operating order number ... surgery code number.

To those mentioned

5000 EGP Medicines Stock Account

5000 EGP medical supplies inventory account

Transferring Medicines from stores to surgery

Thus, until now, this surgery for this patient cost 10,000 EGP of various supplies and medicines.

Determine the cost of the surgery

The first must be in proof of entitlement to our wages for hospital workers:

150,000 EGP from the wage expense account

150,000 EGP to an account of wages and salaries owed to employees

Taking into account insurances and work-earnings taxes

How to make a wage entry in a correct and simple way

After he is entitled to prove his wage entitlement, he begins to bear the cost of the surgery fee based on the number of working hours for the groups that worked in the operation, which means that we see the average hourly wage of the anesthesiologist as well as the average hourly wage of the operation doctor and the average hourly wage

For patients and so on, and accordingly, we see the cost of labor according to the number of hours the surgery took, and this statement is confirmed by this entry:

10,000 EGP from the account of operating order No. ... Surgery No.

10,000 EGP to the wage expense account

note that we have reduced the wage expense, so that it will not appear with us in the income list, but it will be like the cost of the services performed and not an expense

Determine the cost of surgery from other manufacture overhead

Other expenses such as depreciation of medical equipment, insurance costs, real estate taxes and others

It is supposed to estimate the size of the indirect costs that will be added to each month, and on the basis of which I carry them or distribute them to the number of orders I have during this month

For example, I know that I charge a monthly indirect wage for wood of 20,000 pounds, in this case I distribute these costs to the orders I have

I am supposed to distribute the indirect costs using an appropriate distribution basis. In the case of indirect wages, I can use the actual hours for each surgery as the basis for the distribution, meaning that the matter takes 15 working hours and the matter is 16 two working hours

And the order of 17 takes one working hour, and here the distribution ratios will be 1: 2: 3, and then we begin to distribute the indirect wage costs based on these percentage. Then prove it with this entry

2000 pounds from the account of the order No...surgery code.

2000 EGP to the indirect wages account

We measure the rest of the indirect costs related to depreciation, electricity, water, etc. and each component by using it on a different distribution basis, and in the end by collecting the share of the order from this assignment and we assume that 5000 pounds

And so the surgery that The hospital was charged with is: 10,000 pounds for medicine and equipment, 10,000 doctors ’wages and 5,000 pounds its share of other expenses (a total of 25,000 pounds). From here I start setting my pricing policy on the cost I actually incurred for the operation

This means if I am seeking a profit margin of 30%, the service will still be performed, for a fee of 32500 EGP.

After that, we prove the entitlement to service revenue and its cost with these two entries

25,000 EGP from the calculation of the cost of the services performed

25,000 EGP to the account of operating order number.

This is the cost entry

Coming to the restriction entry

32500 from the customer's account.

32500 to the surgical services revenue account

of wages and indirect costs entry:

In the income statement, it is presented as this

32,500 services revenue

(25,000) the cost of the services rendered

75000 EGP gross profit

The manufacturing cost accounting program and factory management provides full control over the production process in terms of materials, costs and even pricing items and goods produced. The manufacturing program allows you to plan expected production processes or new customer requests, by analyzing the time and materials required and available.

It also gives you excellent control over the stocks of raw materials and products in the stores.