In light of the development the world is witnessing in the means of electronic payment and the reduction of reliance on cash payment in financial and commercial transactions at the level of companies and individuals, and what this calls for is the necessity for companies to keep pace with these modern purification methods of issuing invoices and sending them to customers as well as collecting them in a way through electronic payment methods What made many companies turn to the electronic invoicing system, which is characterized by more ease and smoothness in dealing, as electronic invoices can be issued and sent to customers, and even collected instantly in a fraction of a second, which increases the volume of investment and commercial exchange for companies and makes electronic commerce between companies and individuals and between companies Some of them are the easiest, what has paid many parties, led by the Egyptian Tax Authority, which seeks to apply the electronic invoice system to the Egyptian companies in several stages, so that all companies operating in the Egyptian market apply the electronic invoice system by the first of July 2021, so companies must accelerate To the application of the electronic invoice, not only to comply with what the official authorities require, such as the tax authority and others But in order to take advantage of the countless advantages of an electronic bill, and in order to get to know these advantages, one must first know what is an electronic bill?

What is an electronic bill?

The electronic invoice is known as a low-cost system in creating invoices, sending them to customers, collecting them, making the ERP SYSTEM, making amendments to them and archiving them through relying on modern technological means as programs

Which helps companies create invoices in the least possible time by linking the customer’s screen to the data of the sold inventory items to add an infinite number of items to the electronic invoice instantly, as well as linking this electronic invoice to the customer’s data so that the system sends a notification with all the invoice data to the customer as well as the payment data to make it The customer pays the value of the invoice by relying on the technological means of payment such as credit cards, prepaid cards, electronic wallets, etc. Form 10) as well as adding it to the deduction and addition tax form (Form 41) in addition to updating the annual declaration (income tax) of the value of sales and purchases made through the electronic invoice system, all in a momentary manner, and the application of all companies to the electronic invoice system makes sales and purchases recorded For all companies it is very easy.

What are the advantages of the electronic bill application

By applying the electronic invoice system, many benefits are realized for companies, the most important of which are

1- Increasing sales by attracting the largest number of new customers while preserving the current customers, because the world is currently heading for e-commerce, especially after the Corona pandemic, which makes the completion of the sale and purchase processes done electronically via the Internet, marketing, selling and payment all of this is done through the electronic invoice platform instantly and without any Routine procedures; This pushes more customers to buy all their needs from companies that apply the electronic invoice system instead of those that are still using the paper bill system; The electronic invoice system also maintains the existing customers to fulfill their desires for electronic purchase and payment. Including increases the market share of companies and distinguishes them from competitors.

2- Bringing distances closer and reducing time and effort; When you make the purchase decision, you often look for companies near you, because distance is often a hindrance in obtaining a paper bill and it may take days or even months to obtain a paper bill, but through the electronic invoice system you can get a certified and documented bill

To obtain a paper bill, but through the electronic invoice system, you can obtain an approved and documented invoice electronically from the selling company, which increases the volume of investment and trade between companies and individuals and between companies and each other.

3- Reducing administrative expenses costs; What is required for the issuance of paper bills of papers, inks, stationery, printing machines, seals and others can be provided by relying on the electronic invoice. It is also possible to save time lost in writing and entering paper bills. What the electronic invoice system provides in terms of entering the data of the items makes the entry of an infinite number of items. Electronic billing is done in real time.

4- Speed of collection and increase of liquidity; This is because the electronic invoice system depends mainly on linking the invoice to the customer. Once the electronic invoice is created, the system sends a notification to the customer of the invoice value and the due date, which makes the customer always remember the date of payment. The customer also facilitates the payment process by linking the electronic invoice with modern electronic payment methods, which helps in collecting the value of the invoice as soon as possible and reduces bad debts, and then increases the liquidity and profitability of companies. It also reduces the time and effort spent in the collection process.

- This is in addition to the many advantages that are achieved for companies by applying the electronic invoice system, but there are several conditions that must be met before applying the electronic invoice system.

Conditions for applying the electronic invoice

In order to apply the electronic invoice system, companies should

(ERP) The necessity to have an accounting program that links all company departments together (ERP system)

It links the general accounts of the company to the warehouse system that contains all the item data and the sales, purchases, customers and suppliers management screens and links all these screens to the general accounts system to influence the account tree, as well as links the customers and suppliers' invoices to the collection system and banks. Customer account, and then it is impossible for companies that do not have an accounting program to apply the electronic invoice system because the electronic invoice system is part of the accounting program and is complementary to it, so in order for companies to cope with the technological development in the field of payment and electronic invoicing and the new tax system, you must first develop the work system inside The company has its own accounting program that contains all the company’s data, whether financial or warehouse, as well as all customer and supplier data, and the company’s employees must be able to properly and efficiently implement this system in order to implement the electronic invoice system.

An electronic invoice is taxable

The Egyptian Tax Authority seeks to implement the electronic invoice system to be compulsory for all Egyptian companies to implement it by the first of July 2021, and the Egyptian Tax Authority has begun to apply the part of the electronic invoice system to major financiers, due to the advantages it sees in the electronic invoice system that eliminates the parallel economy and reduces opportunities Tax evasion also increases the speed and ease of entering tax returns and the ease of tax examination. To implement the electronic tax invoice system, this requires several stages, as follows:

1 - The company that wants to apply the electronic invoice system tax sends an email to the tax authority requesting registration in the system, attaches the company’s papers to it, the tax authority responds to the e-mail and sets a date for the interview and then goes to the tax office with the assets of the papers, then the authority creates a digital file for the company on the invoice system e .

2- All items of goods or services are coded and then sent to the tax authority on an excel file that is exported from the accounting program to be added to the company's account on the electronic invoice system.

3- The company creates an electronic signature for it through the e-signature companies operating in the Egyptian market.

4- A compatibility is made between the accounting program in the company and the electronic invoice system in order to send the electronic invoice data automatically by linking the accounting program and the system, so the accounting program sends all the data of invoices, customers, items, and payment to the tax system, and the accounting program is linked to customer emails to send invoice notices And discount notices, due dates, as well as collection accounts that customers pay through. The program also updates clients' balances based on electronic payments, and the accounting program fills in all tax returns data automatically through the electronic invoice system.

The best electronic billing program

The Accflex program is one of the best pioneering programs in the application of the electronic invoice system

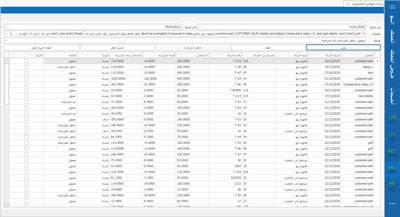

An integrated system that connects all departments of the company through its ERP parts, as it contains a system

(General accounts program - warehouse management program - treasury and banking program - contracting program - human resource management program - ....) and other parts that serve various activities, so the program can be linked to the tax authority's electronic invoice system in a way that makes managing the company's accounts completely Ease and ease and in line with modern electronic systems.