The following we will review AccFlex ERP treasury & banking software cycle, through reviewing the screens of the petty cash and bank transactions, whether by Notes Receivable and Notes Payable or by Bank Transfers as well as Internal Transfers between banks and treasuries or between banks and each other or between treasuries and each other as well as the sub-module of letter of guarantee management and then we will review the most important reports of AccFlex ERP treasury & banking software

I. Petty Cash

Through the Petty Cash screen, a petty cash can be created, selecting whether this petty cash is temporary or permanent, and selecting the employee who will receive the petty cash and the amount of the petty cash, and an attachment to the petty cash transaction can be added through the screen, as well as the petty cash can be settled through the software, and the petty cash can be created directly or to be preceded by a petty cash request.

II. Bank Menu

The Bank Menu contains a set of screens that organize the bank transactions:

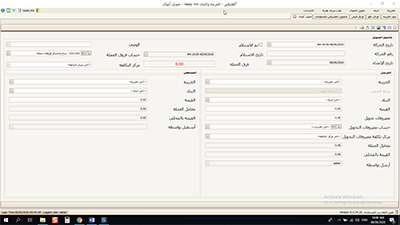

1- Notes Payable screen

The software is characterized by the ability to design a check through the software from Settings, and the check dimensions can be entered and printed directly through the software, it can also add series of checks for notes payable within the software and link them to each bank, which makes the software not allow a check number different from the series of checks for notes payable, and displays a warning message, which is one of the strengths in the software that characterize it from other traditional software, through the Payments screen, the payment process can be created, once the Notes Payable screen opens, you will find a set of payment options, whether (warehouses suppliers- construction suppliers- real estate marketing suppliers- employees- accounts) for example, when you select a warehouse suppliers, all the warehouse suppliers will show you only as all invoices due to the selected supplier appear on the bottom of the screen, so you select the invoice and select the payment value whether (total payment for the entire invoice value- partial payment), and select the amount, as you can pay for construction contractors or make payments for any other accounts payable through selecting accounts, the software provides you the ability to select the type of check, whether it is Open or A/C Payee Only and also change the check status, if it is under collection, delivered, or canceled, is one of the other features in the software that you can import the complete notes payable transaction from an Excel file, which makes the infinite number of transactions entered in a split second, and a document can be added as an attachment to the notes payable transaction through the screen.

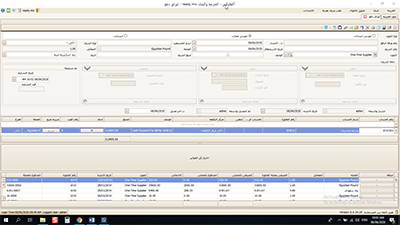

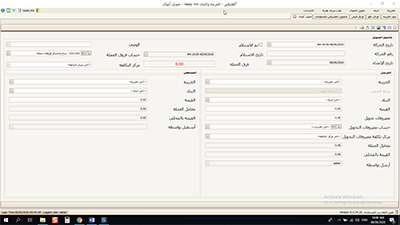

2 - Notes Receivable screen

On the Notes Receivable screen, we find the same distinctive characteristics as on the Notes Payable screen, once we open the Notes Receivable screen, will showing us (warehouses customers- construction customers- real estate marketing customers- petty cash- accounts), all the transactions that are recorded from other sub-modules in the system affect the treasury& banking software, once selecting warehouses customers, will showing all customer invoices, the check amount, check number and the date of receipt is entered and linked to the customer’s invoice, as well as updating the check status (collected- under collection- returned- canceled), if a check is received from other receivables than customers, then you can select “Accounts” and select the offset account to the revenue from the chart of accounts.

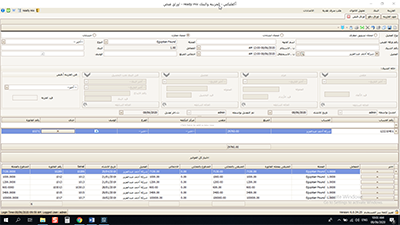

3 - Bank Transfers screen- Receipts / Payments

On the Bank Transfers screen, receipts that are the result of bank transfers from customers can be created, as well as payments made by bank transfers to suppliers, and of course, all the transactions that occur from the Bank Transfers screen affect the accounts receivable and accounts payable as well as other accounts, and one of the advantages of the software is that can be imported bank transfer transactions from an Excel file and documents to a transaction can be added.

4 - A screen to company's internal transfers

In some cases, the company may need to feed the treasury balance, it withdraws money from the bank, and vice versa, it may need to deposit money into the bank from the treasury, so the software provides a set of screens that organize company's internal transfers, through the Transfer Money screen, money can be transferred from the treasury to the bank and vice versa, as well as through the Receive Money (Receipts) screen these transferred amounts can be received, the software also allows you to transfer between two treasuries or transfer between two banks.

5 - Letters of Guarantee

The software provides a submodule related to letters of guarantee management through which letters of guarantee can be created of various types (bid bond- performance bond- advance payment bond) and the letter of guarantee is linked to the customers and selecting the amount of the letter of guarantee and the issuing bank as well as the value of the letter of guarantee, its commission, and the percentage of its coverage if it is there is a facility agreement with the bank, in addition to, the software allows you to perform various transactions on the letter of guarantee, whether by (increase the letter of guarantee value- decrease the letter of guarantee value- cancel it- extend a letter of guarantee- liquidate a letter of guarantee) and the software creates all journal entries that occur on the letter of guarantee automatically without the need to enter it, and direct impact on the chart of accounts.

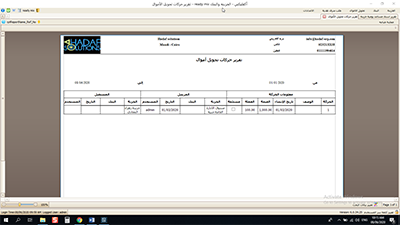

III. Reports

A - Treasury Reports

The software provides a unique set of reports that cover all the information that a user needs of the treasury, whether for cash transaction made through the screens of the receipts, payments, or petty cash, as well as reports covering the parties associated with the treasury, such as accounts, petty cash, suppliers, and customers, and the most important of these reports (Payments Report- Receipts Report- Treasury Report by date- Treasury Cash Book Report- Treasury Transactions Report- Petty Cash Report- Account Balances Report......).

B - Bank Reports

The software provides a unique set of reports that cover all the information that a user needs of the bank, whether for transactions made through the screens of the notes receivable, notes payable, bank transfers, or internal transfers as well as reports covering the parties associated with the bank such as accounts, petty cash, suppliers, and customers and the most important of these reports (Notes Payable Report, Notes Receivable Report, Bank Book Report, Bank Reconciliation Report, Bank Account Balance Report by date, Account Balances Report, Receipts Report-Bank Transfers, Payments Report-Bank Transfers, Money Transfer Report, Money Receipt Report ....).

C - Letters of Guarantee Reports

The software provides you a unique set of reports covering all the information about the letters of guarantee, through the letters of guarantee reports, you can display all the data of the letters of guarantee (letter of guarantee number- its data- issuing bank- its value- its commission- its type ...) and you can also search for the letter of guarantee by any of the parameters, whether the type of the letter of guarantee, it displays only the bid bond, performance bond, or the advance payment bond, the status of letter of guarantee can be displayed whether it is open-closed, and all transactions made on the letter of guarantee can be displayed whether by (increase the letter of guarantee value- decrease the letter of guarantee value- cancel it- extend a letter of guarantee- liquidate a letter of guarantee) this provides all the information that the user needs about the letters of guarantee.