Accounting journal entries are considered as an organizational way to record all financial transactions of a particular activity; in the construction activity, all of its financial transactions are expressed by recording the journal entries for all stages of the project starting from the buy the tender specifications until the final completion, and the accounting journal entry requirement to be equal both the journal entry sides (debit and credit), the accounting journal entry is considered to be a stage of the accounting cycle for accounts related to construction, and then posting in the general ledger, and a subset of it a sub-ledger is created for each account and then the trial balance is prepared, ending with the financial statements, the following is mentioned for the most important accounting journal entries for construction accounting through the practical reality of the general ledger of the general contractor

Journal Entries for Construction Companies

1- Accounting journal entries for buying the tender specifications

When a client submits a bid, it is creating a booklet that contains all the technical and financial conditions, bill of quantities and plans for the implementation of a specific process, once the construction company is bought to tender specifications, the journal entry is created as follows:

|

Account |

Debit |

Credit |

|

General and Administrative Expenses |

XXXX |

|

|

Cash on hand/ Bank |

XXXX |

In the case that awarding a bid (tender) to the construction company, the general and administrative expenses in the project costs will be closed and the journal entry will be as follows:

|

Account |

Debit |

Credit |

|

Project costs |

XXXX |

|

|

General and Administrative Expenses |

XXXX |

2- Accounting journal entries for the bid bond

After buying the tender specifications, the construction company (technical office) examine all the financial and technical details of the project mentioned in the tender specifications and prepare the financial offer to enter the tender in addition to the technical offer and it is required to pay the bid security before attending the bids opening and the bid security is often within 1 to 2% of the value of the operation, and it is to be paid, in cash, or under to a bank guarantee letter, and the accounting journal entries are created as follows:

|

Account |

Debit |

Credit |

|

Banks letters of guarantee - bid bond |

XXXX |

|

|

Commission of letters of guarantee- bid bond |

XXXX |

|

|

Bank |

XXXX |

3- Accounting journal entries for the performance bond

The company that owns the project (the client) examines the technical and financial offers provided by the construction companies and in the latter selects a construction company to implement the process and to ensure the proper implementation requires that (the general contractor) the construction company assigned to implement the project a performance bond and be often within 5% of the value of the operation and its journal entries are as follows:

|

Account |

Debit |

Credit |

|

Banks letters of guarantee - performance bond |

XXXX |

|

|

Commission of letters of guarantee- performance bond |

XXXX |

|

|

Bank |

XXXX |

4-Accounting journal entries for the advance payment guarantee/bond

Once the general contractor has received the project, the customer will pay the advance payment to the general contractor and a proportion of the contract value is to be deducted from the payment certificates of the general contractor and the general contractor will make an advance payment guarantee/bond to the customer until he pays the payment and the journal entries are as follows:

When advance payment is paid

|

Account |

Debit |

Credit |

|

Bank |

XXXX |

|

|

Accounts receivable |

XXXX |

Advance payment guarantee/bond

|

Account |

Debit |

Credit |

|

Banks letters of guarantee - Advance payment bond |

XXXX |

|

|

Commission of letters of guarantee- Advance payment bond |

XXXX |

|

|

Bank |

XXXX |

5- Accounting journal entries for project costs

Once the site is received and the advance payment is paid, the general contractor starts project implementation, the project costs are divided into site labor costs- purchases of mortar materials for the project- subcontractors- overhead expenses.

|

Account |

Debit |

Credit |

|

Project costs |

XXXX |

|

|

Project Labor Cost |

XXXX |

|

|

Purchases - mortar materials |

XXXX |

|

|

Rent Expense- Equipment |

XXXX |

|

|

Cash on hand/ Bank |

XXXX |

The payment can be paid through the petty cash of the project by paying it from the main treasury and is subsequently settled as follows:

A. When the petty cash is paid

|

Account |

Debit |

Credit |

|

Petty cash |

XXXX |

|

|

Cash on hand/ Bank |

XXXX |

B. When the petty cash is settled

|

Account |

Debit |

Credit |

|

Project costs |

XXXX |

|

|

Project Labor Cost |

XXXX |

|

|

Purchases - mortar materials |

XXXX |

|

|

Rent Expense - Equipment |

XXXX |

|

|

Petty cash |

XXXX |

Also, materials can be purchased on credit

|

Account |

Debit |

Credit |

|

Project costs |

XXXX |

|

|

Purchases - mortar materials |

XXXX |

|

|

Accounts Payable (building materials accounts payable) |

XXXX |

6- Accounting journal entries for subcontractors

The general contractor hires one of the subcontractors to implement a specific item of the project such as plumbing works, electricity works, ceramics...etc. the accounting treatment is as follows:

A- When accrual for the subcontractor

|

Account |

Debit |

Credit |

|

Project costs |

XXXX |

|

|

Subcontractors work |

XXXX |

|

|

Subcontractor |

XXXX |

|

|

Advance payments - Subcontractor |

XXXX |

|

|

Retention - Subcontractor |

XXXX |

|

|

Withholding Tax |

XXXX |

B. When paying to the subcontractor

|

Account |

Debit |

Credit |

|

Subcontractor |

XXXX |

|

|

Cash on hand/ Bank |

XXXX |

7- Accounting journal entries for revenue (customer payment certificate)

The general contractor implements the works and issued the payment certificate of the works implemented after surveying it for the customer and the journal entries are as follows:

A- When accrual for the customer payment certificate

|

Account |

Debit |

Credit |

|

Accounts Receivable |

XXXX |

|

|

Advance payments - Accounts Receivable |

XXXX |

|

|

Retention- Accounts Receivable |

XXXX |

|

|

Withholding Tax |

XXXX |

|

|

Accrued Revenue |

XXXX |

|

|

Sales Tax |

XXXX |

B. When the payment certificate is paid

|

Account |

Debit |

Credit |

|

Bank |

XXXX |

|

|

Accounts Receivable |

XXXX |

This was an explanation of some of the accounting journal entries of the construction company, and after we learned about the accounting journal entries in the construction companies, we explain how the chart of accounts is designed for the construction company

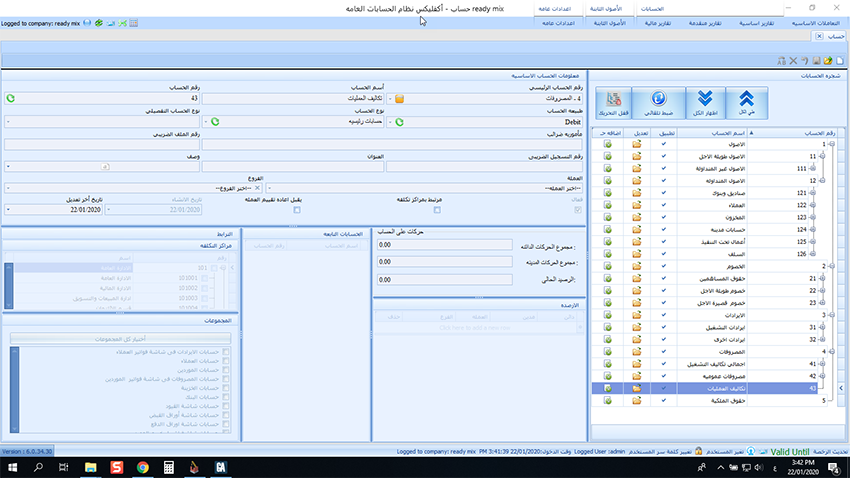

Chart of accounts for the construction company

If we want to design a chart of accounts for a company, we must first get to know the company activity to design a chart of accounts that suitable for it and be more flexible in organizing the accounts in it, in the construction companies, some accounts which are characterized them from other and that you need for the business flow and organizing the accounts in the construction companies and the chart of accounts can be displayed as follows:

|

Account Code |

Account Type |

Account Name |

Description |

|

1 |

Fixed Assets |

||

|

1.1 |

Buildings |

||

|

1.1.1 |

Headquarters Building in Cairo |

||

|

1.1.2 |

Project Management Building- Alexandria |

||

|

1.2 |

Land |

||

|

1.2.1 |

Land in New Administrative Capital |

||

|

1.2.2 |

Land in Suez |

||

|

1.3 |

Vehicles |

||

|

1.3.1 |

Pickup truck |

||

|

1.3.2 |

Minibus |

||

|

1.4 |

Computer equipment |

||

|

1.5 |

Office equipment |

||

|

1.6 |

Furniture and fixtures |

||

|

1.6.1 |

Administrative offices in Cairo headquarters |

||

|

1.6.2 |

A conference room |

||

|

1.7 |

Equipment & Machinery |

||

|

1.8 |

Tools |

||

|

1.9 |

Security & Safety Equipment |

||

|

2 |

Current Assets |

||

|

2.1 |

Cash On Hand |

||

|

2.1.1 |

Main Treasury |

||

|

2.2 |

Bank/Cash at Bank |

||

|

2.2.1 |

National Bank of Egypt |

||

|

2.2.2 |

Housing & Development Bank |

||

|

2.3 |

Accounts Receivable |

||

|

2.3.1 |

Armed Forces Engineering Authority |

||

|

2.3.2 |

Rowad Modern Engineering Company |

||

|

2.3.3 |

SIAC Company |

||

|

2.4 |

Petty cash |

||

|

2.4.1 |

Petty Cash - Ahmed Essam |

||

|

2.4.2 |

Petty Cash - Mohamed Samir |

||

|

2.5 |

Inventory |

||

|

2.5.1 |

Machinery and Equipment Warehouse |

||

|

2.5.2 |

Spare Parts Warehouse |

||

|

2.6 |

Construction Work-in-Progress |

||

|

2.6.1 |

Projects of the Ministry of Foreign Affairs building in the Military entity |

||

|

2.6.2 |

Project of construction of Union National Bank in New Administrative Capital |

||

|

2.7 |

Notes Receivable |

||

|

2.8 |

Prepaid Expenses |

||

|

2.9 |

Accrued Revenue |

||

|

2.10 |

Letter of Credit |

||

|

2.11 |

Advances paid to employees |

||

|

2.12 |

Other Receivables |

||

|

2.12.1 |

Accounts Receivable Retention |

||

|

3 |

Current Liabilities |

||

|

3.1 |

Accounts Payable |

||

|

3.1.1 |

Accounts Payable - Electrical Materials |

||

|

3.1.2 |

Accounts Payable - Plumbing Materials |

||

|

3.2 |

Subcontractors |

||

|

3.2.1 |

Subcontractors - Marble works |

||

|

3.2.2 |

Subcontractors – Plaster works |

||

|

3.3 |

Notes Payable |

||

|

3.4 |

Short-term loans |

||

|

3.4.1 |

Project Finance - National Bank of Egypt |

||

|

3.5 |

Provisions |

||

|

3.5.1 |

Allowance for Depreciation |

||

|

3.5.2 |

Allowance for Doubtful Accounts |

||

|

3.6 |

Other Creditors |

||

|

3.6.1 |

Tax Authority |

||

|

3.6.2 |

Social insurance |

||

|

3.6.3 |

Third Party Deposits |

||

|

4 |

Long-term Liabilities |

||

|

4.1 |

Long-term loans |

||

|

4.1.1 |

Long-term loans - Banque Misr |

||

|

5 |

Equity |

||

|

5.1 |

Capital |

||

|

5.2 |

Retained Earnings |

||

|

5.3 |

Reserves |

||

|

5.4 |

Current account partners |

||

|

6 |

Expenses |

||

|

6.1 |

Project Cost |

||

|

6.1.1 |

Day labor |

||

|

6.1.2 |

Purchases- mortar |

||

|

6.1.3 |

Rent- Equipment |

||

|

6.1.4 |

Work - subcontractors |

||

|

6.2 |

General And Administrative Expenses |

||

|

6.2.1 |

G&A Labor |

||

|

6.2.2 |

Rent - Head office |

||

|

6.2.3 |

Depreciation |

||

|

6.2.4 |

Bidding Documents |

||

|

6.2.5 |

Utilities |

||

|

6.3 |

Selling and Marketing Expenses |

||

|

7 |

Revenues |

||

|

7.1 |

Activity Revenues |

||

|

7.1.1 |

Revenue- the process of constructing National Bank of Egypt building |

||

|

7.1.2 |

Revenue- the process of constructing Ministry of Foreign Affairs building |

||

|

7.2 |

Other Income |

||

|

7.3 |

Revenues from Previous Years |

A sample of the chart of accounts in AccFlex constructions software

Best Construction Project Management Software

After we mentioned the method of recording accounting journal entries in construction companies and reviewed a chart of accounts sample for a construction business, we must mention that relying on the traditional approaches (paper-based) in recording accounting journal entries in the construction company, it is characterized by very slow as well as it's not appropriate for the technological progress in the construction and contracting sector, if the construction company has many sites and thousands of staff, workers and subcontractors, it would have been very difficult to organize financial matters and calculate the subcontractors payment certificates properly and accurately, in addition to the inaccuracy of calculating the client payment certificates and thus the inaccuracy of revenue means the occurrence of losses to the construction company (higher costs and lower revenues), in addition to weak control of sites, financial reporting delay and it's not appropriate for working conditions and thus finance department has become ineffective because of it relied on traditional approaches that are never appropriate for the large expansion of construction companies, therefore, it was necessary to rely on construction accounting software, and we will show the best construction accounting software as follows

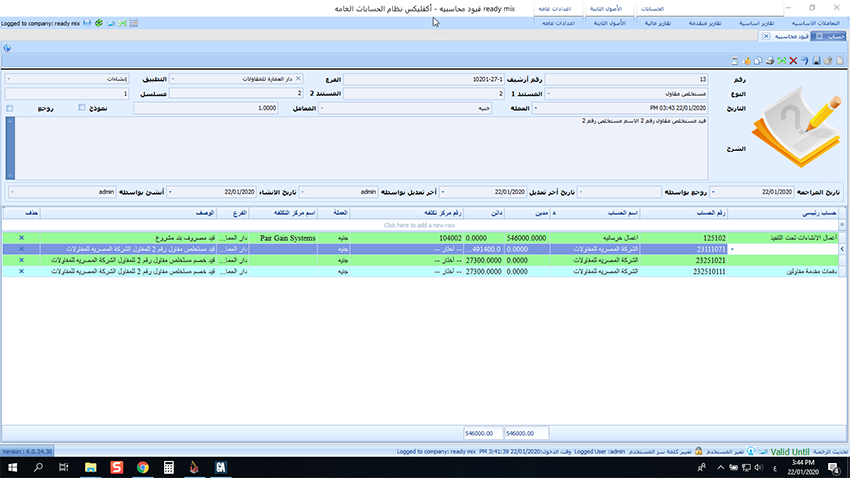

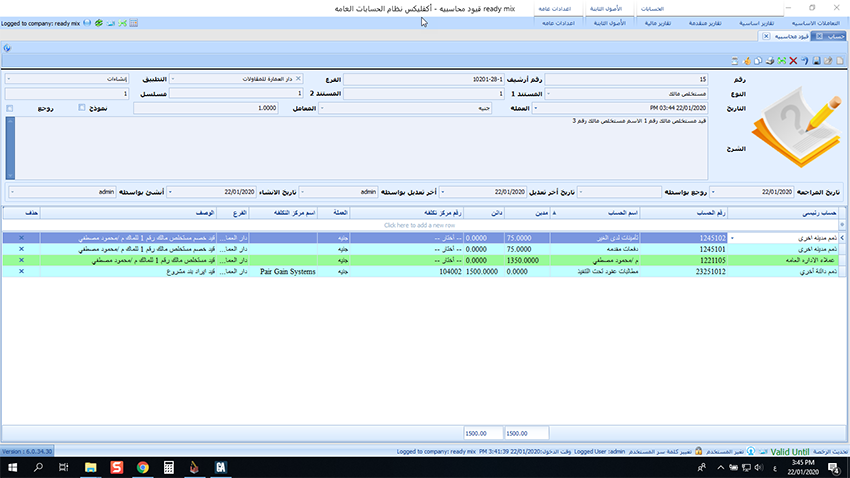

Creating accounting journal entries in AccFlex constructions software

There are a set of advantages that are characterized by AccFlex constructions software in creating and preparing journal entries, as well as showing accounting reports of construction companies, which can be mentioned as follows

1- Creating journal entries automatically

AccFlex constructions software creates the journal entries automatically as soon as the financial transactions are created, once making the subcontractor payment certificate or the owner’s payment certificate, for example, the software creates the accounting journal entry as the screen shows without user intervention.

2- Flexibility in editing accounting journal entries

AccFlex constructions software creates the journal entries automatically, it also allows you to add or edit one of the line items according to the user, and the withholding tax calculation may change in one of the line items, the price of a specific item may change, and AccFlex constructions software allows you the ability to edit.

3- The ability to search for accounting journal entries

AccFlex constructions software enables you to search and edit accounting journal entries, whether by date or reference number and document number etc. of search parameters that increase the flexibility of AccFlex constructions software.

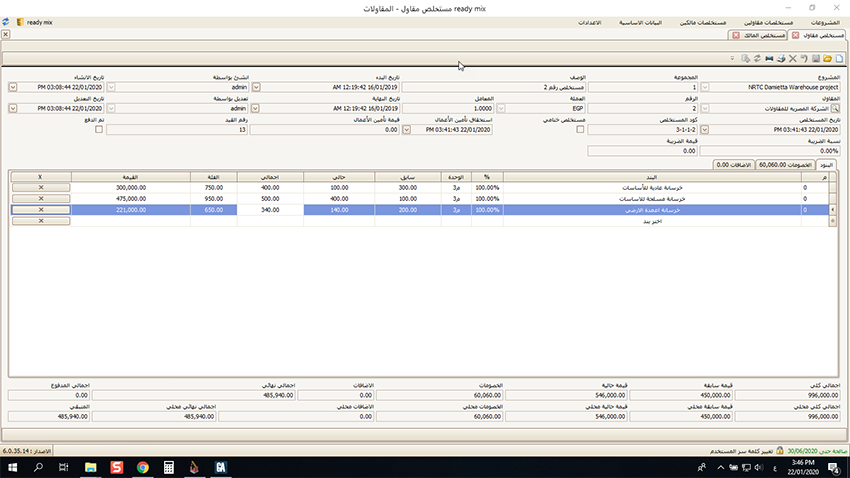

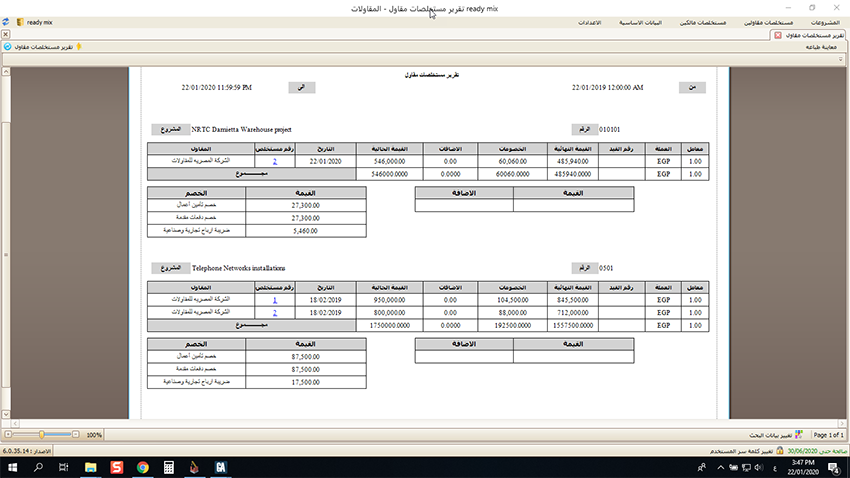

4- Sub-contractor Summary Report

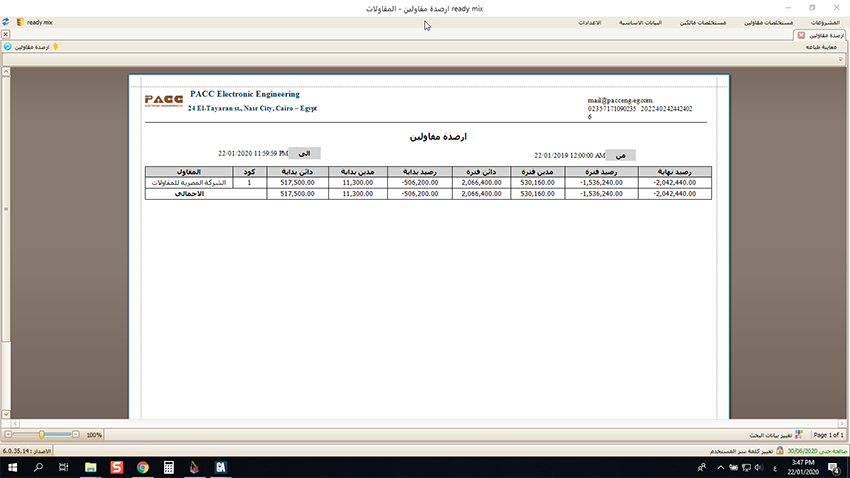

AccFlex constructions software provides you to know the accounting impact of the journal entries in reviewing the balances of the sub-contractors; you can see the accounting impact of the journal entries of the sub-contractors on the transaction of the balance.

5- Owner Balance Report

AccFlex constructions software provides you to know the accounting impact of the owners' journal entries through the owner balance report, so all transactions can be determined of their balances and make sure the balance is matched.

The role of construction contracts in construction accounting software

A construction contract is an agreement document between two parties of both the client (the owner of the project) as the first party and the construction company (the general contractor) as the second party, defining the rights and obligations of each party, and the construction contracts have a specialized nature in terms of their conditions/ terms and specifications that uniqueness them from the rest of the contracts for any other activity in the contracts of the construction companies, must it has the common characteristics which are:

1- Contract Form

It contains the contract agreement between the client and the contractor for the project implementation and determining the project costs and the delivery period and other key contract terms.

2- Design Drawings

It contains all the engineering drawings and technical plans necessary for the project implementation.

3- Conditions of Contract

These are the conditions that the owner (the client) imposes on the general contractor and which must be complied with, there are general conditions known to all construction contracts in addition to special conditions imposed by the owner on the construction contract, to ensure that the project is implemented as wanted and the penalty clauses and others.

4- Bill of Quantities

It is quantity surveying covered by the construction contract in terms of the quantity of works and the price of the items and very similar to the survey-based cost estimation and it is subject to increase or decrease when the actual implementation.

5- Project Schedule

They are timelines that show the duration of the implementation of each project item in a way that represents the bill of quantities and is also subject to variance, both by implementation before or after the planned time when the project is actually implemented.

Construction accounting software has a significant role in the project contracts implementation as planned, so it is possible through construction accounting software to enter all construction contract data of bill of quantities and priced bill of quantities as well as the project schedule and contract form as well as conditions of the agreement with the owner in addition to engineering and technical plans and create a comprehensive project budget includes all financial, technical, and time aspects, once the project is implemented, construction accounting software directs the construction company (general contractor) towards variances during implementation, which helps the company to change the work implementation plan and avoid negative variances and then implement the work as planned at the same cost and the planned time and the same technical and financial conditions agreed upon with the owner to achieve for a construction company cost savings and thus profit maximization