Features of Cash Management Software

Treasury & Banking Software that works by ERP System has specialized in treating the collection and payment processes whether in cash or through notes receivable, notes payable, and checks and controlling cash and banking transactions.

Treasury & Banking Software works in a coherent and integrated manner with Inventory Management Software, General Ledger Software, AccFlex Constructions Software, Real Estate Marketing Software, and Human Resources (HR) Software, where all collections and payments are translated into journal entries that are included in General Ledger Software.

Watch the work cycle of AccFlex ERP Treasury & Banking Software

Through the Cash Management Software, you can make payment of any outstanding invoice and receive any amounts of AP invoice, where Treasury & Banking Software does the following: -

Creating Journal Entries Automatically

Treasury & Banking Software creates accounting journal entries automatically without the need to enter the journal entries, AccFlex ERP Treasury & Banking Software is distinguished from other accounting software have enough flexibility to makes the possibility of bringing about change in the company and switching from the manual work system as soon as possible.

Importing from Excel

Treasury & Banking Software supports the possibility of importing from Excel, also, the Cash Management Software can be used to more than one branch and link all the branches to each other into a single database, Treasury & Banking Software also features inclusivity, you can manage treasury and bank accounts, full access to all reports, designing and printing checks from Treasury & Banking Software without the need for any extra assistance accounting software, in addition to that Treasury & Banking Software is provided to all companies, regardless of their size (large scale, medium-sized, small), as the Treasury & Banking Software has been designed to suit all activities.

Warning and Error Messages

In addition to a full system for controlling cash transactions starting from warning messages when an error occurred and alert messages when needed and authorizations setting screens and customized screens for entering specific transactions.

We offer ideas that develop your business

1- Features of Treasury & Banking Software

- The software codifies banks, treasury, methods, and terms of payment and links them to General Ledger Software.

- The cash transaction within the company is recorded of payment voucher and receipt voucher within the system, the system treats them automatically, creating their accounting journal entries and posting it to General Ledger Software.

- The ability to deal with the treasury and track its transactions through receipt voucher and payment voucher that create an automated accounting journal entry.

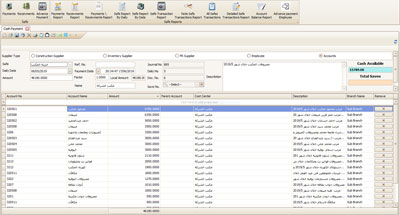

- The ability to display all the transactions made on the treasury with its different account numbers and displaying them in the form of cash transaction statements within the window of accounting software.

- The ability to track all transactions of receipt vouchers and payment vouchers and the effects of their accounts on the treasury in the window of accounting software.

- The software follows up the notes receivable since the receipt and then the payment is complete, as well as the notes payable from the moment of issuance until the completion of the payment and follow up their bank accounts in the window of accounting software.

- The system compares the bank statements with the transactions entered into the system according to the user's vision.

- The ability to track the withdraw and deposit movements of each bank and display a detailed account statement showing the balances of these banks.

- The ability to review all transactions made on banks through the system and issues an account statement issued by the system to match it with the bank statement issued by the bank (bank reconciliation).

- Accounting software that automatically creates transitory items and posts them into General Ledger Software.

- Accounting software that tracks the transaction of checks and notes payable from receiving, sending, and exporting to the bank.

- Full control of payment portfolio and receipt portfolio in the window of accounting software.

- Advanced user-level authorizations system for saving, editing, deleting, and printing operations for each transaction.

A report to accounts receivable checks/accounts payable checks once Treasury & Banking Software is opened

One of the most important features of AccFlex ERP Treasury & Banking Software is that of the other accounting software, once the software is opened, you will show all checks (accounts receivable/accounts payable) for the next week, which will help you in planning your cash and preparing a sufficient balance for the amounts due to pay (notes payable) as well as following up your collections from through the report of due checks to collect (notes receivable).

Design your checks from Treasury & Banking Software

Treasury & Banking Software provides you the ability to design your checks for each bank in terms of measurements of length, width, height of the check and check data, to help you print the check from Treasury & Banking Software with ease, and you can create an infinite number of designs.

Treasury & Banking Module

Treasury & banking module software is specialized in processing the transaction of cash and banks and monitoring collection and payment processes, whether in cash or through notes receivable and checks payment

Treasury & banking module works in linking and integrated with inventory management module, general ledger module, human resource module, AccFlex constructions software and marketing and real estate investment management module, where all collections and payments are translated into journal entries that are included in general ledger module.

Treasury & Banking Module consists of the following main screens

Treasury Screen

Through the treasury screen, collection and payment processes are organized directly from the organization's treasury, as the software provides an integrated system of payment, collection and transfer transactions between treasury.

1) The Payments System Screen

Through the Payments screen, the user can create payment transactions whether they are for a specific vendor "by selecting the vendor and the invoice to be paid" or on any other account of the items of expenses. The user can also create payment transaction through the petty cash.

2) The Receipts System

Through the receipts screen, the receipts and collection transactions are created, whether through a specific customer "by selecting the customer and the invoice to be collected" or through another account from the revenue items, and it can also be collected from more than one source in the same collection transaction.

Treasury & banking module is characterized by the ability to import payment and collection transactions through an external Excel sheet directly and with high accuracy to save time and effort.

3) The petty cash system in Treasury & banking module

Treasury & banking module provide an integrated system for the creation and settlement of all types of petty cash, and the petty cash is created and linked to the received employee. After the purpose of it is out, it can be settled with the treasury accountant and record the payments processes through the petty cash and then collect the remainder or replace with other amounts if the permanent advances.

The accounting software provides the ability to record the payments of the petty cash through supporting documents for sources and aspects of payment.

4) Transactions of transfer between treasury:

Through the transfer system between treasury, the user can create a transfer transaction from treasury to another, provided that the person in charge of the other treasury confirms the receiving process from the sender. You can also create a transfer from bank to bank, from bank to treasury, or from treasury to bank.

Bank Screen

The bank screen is specialized in recording the collection and payment processes through the accounts of the organization in the banks, the system also provides full accounting processing for all stages of the checks cycle " notes receivable " starting from record of receiving them from the customer and inserting them in the treasury of the notes receivable in the organization and until they are collected from the bank or returned or canceled or dishonored.

The software also provides the integrated cycle of payments through outgoing checks by the organization.

1) Notes payable

Through the notes payable system, the payment transaction to vendors or to any item of expenses is recorded by issuing checks from the organization where the process of issuing a check to the beneficiary is recorded by inserting the check number, amount, beneficiary, type of check and due date, and the status of the check is changed, either by register the process of collecting the check from the beneficiary and reducing the balance of the organization’s account in the bank or its returning and cancelling.

2) Notes receivable

Through the notes receivable system, collections from customers are registered through the incoming checks. The collection process is recorded in the notes receivable treasury by entering the check number, amount, type, and the name of the entity issuing the check.

The transaction of checks is tracked by sending the bank to the collection and registering the collection commission.

The system provides accounting solutions and treatment for all scenarios and stages of the checks cycle

3) Payments - Bank Transfer System

And through which the direct payment process is recorded through the organization's current account in the bank to the beneficiary, "as in cases of online payment", and the user can record the payment process through bank transfer from the company’s account to the beneficiary's account or cash withdrawal from the account.

4) Receipts - Bank Transfer System

Through the process of bank transfer of receipts, the receipts that were made on the accounts of the organization on the bank are recorded by the customers, whether through the direct deposit process in the organization’s account or through the transfer from the customer’s bank account to the company’s bank account.

Internal control system

Treasury & banking module provides an integrated system of internal control by granting authorizations to users according to their specialties such as granting a user the authorization to payment transactions or collections transactions only. The user is granted the authority to produce treasury reports, and the internal control system is established according to the size and nature of the organization's activity.

Settings screen

The settings screen specializes in entering the properties of the organization, such as the name, type of organization and its logo, and the basis for the system's work is also developed, such as the creation of the main and subsidiary treasury and the creation of banks, also, the user can print checks through a module, custom form for printing.

Treasury & banking module is also characterized by its ease of use, whereby AccFlex ERP programmers’ team avoided all the weaknesses of other accounting software that are specializes in the transaction of banks and cash, AccFlex ERP team will continue to keep up with the software updates and accounting and provide the software with it on an ongoing basis.

To find out the best prices for accounting software and to book treasury & banking module, request for quotation now.

Create a chart of accounts for your company treasury:

The master and subsidiary treasury can be created depending on the business requirements and the size of the company, and treasury accounts can also be linked to the "General Ledger Module" chart of accounts to control the operations of the accounting treatment (Pre-Posting) related to the treasury.

The treasury user interface screen includes the following detailed data:

-Treasury Name

-Initial Balance

-Branch Name

-General Ledger Account

-Select Chart of Accounts

- Created on

- Linking receipts to customers’ invoices and documents:

All collection transactions that are done in treasury& banking module, whether in cash, in the treasury, in banks, or through notes receivable, can be linked with documents such as:

- Linking receipts from the customers with the sales invoices, in order to help determine the accounts receivable Aging ((A/R) Aging) and the uncollected invoices from the customers.

- Linking the receipts that are done from employees "as a refund the advance to the treasury" with the advance document previously issued in personnel administration module.

- Linking receipts related to suppliers due to the return of some items to incoming invoices.

- Linking receipts from the owners to the owners' payment certificates issued in contracting module.

- Linking receipts related to the installments due as a result of a contract to sell units in real estate investment management module.

- Linking the receipts that are done directly to a certain account in the chart of accounts under receipt voucher.

- Create payment and receipt transactions from external files:

To save time and effort, all payment and receipt transactions that was done during the period can be imported with an external excel sheet all at one go and in a simple way.

Importing all treasury transactions (receipts/ payments) from an Excel file

One of the most unique features of AccFlex ERP Treasury& Banking Software, the flexibility in the input, you can import an infinite number of payment/ receipts transactions to the treasury from an Excel file and add it to the software in a split second.

- Employees Petty Cash Management

Treasury & banking module provides an integrated system to manage the petty cash includes the following:

-Adding different types of petty cash: "petty cash of transportations, petty cash of purchases, petty cash of expenses… etc."

-Printing the receipt received of petty cash for the signature of the received employee.

- Settling petty cash in different payments accounts.

- Returning all or part of the petty cash after the end of its purpose.

- Detailed reports on the petty cash and the petty cash which has been settled.

A typical cycle of petty cash

Treasury & Banking Software provides you a typical cycle of the petty cash, starting with the payment order to a petty cash and then approving the payment order to the petty cash, then the payment transaction to the petty cash itself and then settling the petty cash, and it provides you the freedom to commit to petty cash payment according to the typical cycle (a payment order followed by the petty cash payment) or petty cash payment dire.

Create a chart of accounts for banks:

A chart of Accounts can be created for the banks the company deals with, including a detailed description of the company’s account in the bank and the balance, as well as the bank policy for dealing with the bank account.

The banks user interface screen includes the following detailed account details:

Bank Details :-

- Bank Account Number.

- Bank Name.

- Initial Balance.

- Currency.

- Bank Account:

- General Ledger Account.

- Select Chart of Accounts.

- Other Accounts:

- Notes Receivable.

- Notes Payable.

- Refusals forecasts.

- Returned forecasts.

- Checkbook:

- Control of checkbooks serial numbers.

Cash Transfers

Between the treasuries and each other, or between the treasury and the bank, or between the bank and the treasury, as well as transfers between the checks treasury to the cash treasury directly.

Transfers and receipts are made according to the authorization of each user on the transferred or received treasury.

Screens to cash transfers management to receipts

Through the Bank Transfer to Receipts screen, you can enter adding of all incoming transfers from accounts receivable, as well as select the type of customer/ account that you want to amounts collect from, whether it is (construction customers- warehouses customers- tourism customers- real estate marketing customers) and once you select any type of them it shows you all the outstanding invoices to collect from the customer selected to the same screen, or selecting which account you want to collect from the chart of accounts, as well as selecting whether this transfer (cash deposit- bank transfer) and the documents can be added to any receipts transaction.

Screens to cash transfers management to payments

Through the Bank Transfer to Payments screen, you can enter adding of all outgoing transfers to suppliers, as well as select the type of supplier/ account that you want to pay for, whether it is (construction suppliers- warehouses suppliers- tourism suppliers- real estate marketing suppliers) and once you select any type of them it shows you all the invoices due to the supplier selected to the same screen, or selecting employees petty cash and selecting the employee for whom you want to pay a petty cash for him or selecting which account you want to pay for from the chart of accounts, as well as selecting whether this transfer (cash deposit- bank transfer) and the documents can be added to any payments transaction.

Importing all bank transactions (receipts/payments) from an Excel file

One of the most unique features of AccFlex ERP Treasury & Banking Software the flexibility in the input, you can import an infinite number of payment/receipt transactions to the bank from an Excel file and add it into the software in a split second.

Screens to Internal Transfers Management

AccFlex ERP Treasury & Banking Software provides you a submodule related to the company's internal transfers between the treasury and the banking, and vice versa, as well as transfers between the company's banking, through which transfers can be made through a Transfer screen and a screen to receive amounts to (banking/ treasury), with the ability to set up the authorizations of each user in the transfer process, also, documents can be added to any transfer transaction.

An Integrated Cycle for Incoming/Outgoing Checks

- The checks cycle begins with receipt from customers or the issuance of checks to suppliers, then checks can be tracked at all phases of their collection, whether it is direct collection through the bank, or collection through clearing transactions.

- The returned check can be registered or canceled for any reason and then affect the customer’s statement after the return process

- All bank expenses relating to the collection or returning of checks can also be registered in the phases of the checks cycle.

- All phases of the checks cycle are translated into journal entries that are done automatically in General Ledger Software.

- Producing detailed reports to track and collect the checks.

A screen to link between notes payable and supplier invoices

Through the Notes Payable screen, you can enter the check number and the drawee bank name, the software also displays you a warning message in the case that you enter an incorrect check number that is not linked to the bank and also select the type of supplier/ account that you want to pay for whether it is (construction suppliers- warehouses suppliers- tourism suppliers- real estate marketing suppliers), once you select any type of them, it shows you all the invoices due to the selected supplier to the same screen, or selecting employees petty cash and selecting the employee for whom you want to pay a petty cash to him or selecting which account you want to pay for from the chart of accounts, and you can select the type of outgoing check to the supplier and once you select the type check appears to you its design (open- crossed- A/C payee only....), and the documents can also be added to any payments transaction.

A screen to link between notes receivable and customer invoices

Through the Notes Receivable screen, you can enter the revenue check number and the drawee bank name, as well as selecting the type of customer/ account to collect amounts from, whether it is (construction customers- warehouses customers- tourism customers- real estate marketing customers) and once you select any type of them it shows you all the outstanding invoices to collect from the customer selected to the same screen, or selecting employees petty cash and selecting the employee for whom you want to return a petty cash from him or selecting which account you want to collect from in the chart of accounts, the software also provides you the ability to receive the note receivable in the notes receivable treasury before sending it to the bank for collection, and the documents can be added for any receipts transaction.

Updating check status from the software

Once a note payable/ a note receivable has been entered into Treasury & Banking Software, the software requires you to select the check position (delivered- bounced from the bank- canceled- under collection ...) and as soon as any of these status occurs once the type of status is selected, the software creates status journal entries (cancellation- return- collection- delivery...) automatically, and all bank accounts- treasury- accounts payable and accounts receivable are affected, as well as bank expenses if any of the previous processes result in bank expenses.

Online Banking Transfer-Transactions Management

These are the payment and receipt transactions that are done on the bank account through online transfer, or direct payment and collection on the account, the Bank Transfers screen is used for receipts and payments in the following cases:

-Registering of customer deposits in the bank account directly by the customer or through online transfer.

-Registering of deposit "bank payments" that are done to bank accounts through online transfer or direct cash withdrawal from the bank account.

- Payment processes to different entities, which are done by credit cards.

Letters of Guarantee in Treasury & Banking Software

Letter of Guarantee Management screen

AccFlex ERP Treasury & Banking Software provides you with a submodule related to the letter of guarantee management through which you can create a letter of guarantee for any customer, whether it is (construction customers- warehouses customers- tourism customers- real estate marketing customers) or selecting an account and create a letter of guarantee that does not belong to an existing customer, and select the type of letter of guarantee, whether it is (bid bond- performance bond- advance payment bond), as well as selecting the issuing bank, and the guarantee cover- the letter of guarantee expenses- the bank interest of letter of guarantee, the software also creates all journal entries of letters of guarantee automatically, as well as the ability to select the cost center assigned to the letter of guarantee.

The ability to adjust letter of guarantee status

AccFlex ERP Treasury& Banking Software provides you the ability to adjust letter of guarantee status (increase the letter of guarantee value- decrease the letter of guarantee value- extend a letter of guarantee- cancel a letter of guarantee- liquidate a letter of guarantee), and it also provides you a screen through which you can review all the transactions that recorded to the letter of guarantee by date, and the software creates all adjustment journal entries to letters of guarantee automatically.

Detailed and aggregate reports for cash management and the financial system as a whole

AccFlex ERP Accounting Software is characterized by providing a set of detailed reports that cover all parts of the financial and management system as a whole. Examples of reports provided by Treasury& Banking Software the following:-

First, Reports related to treasury

- Payments/Receipts Report

- Treasury Statement Report with a certain date

- Treasurer's Cash Book Report

- Detailed Treasury Transactions Report

- Employees Petty Cash Report

- Treasury Balances Report

Second, Reports related to banking transactions

- Payments Report - Bank Transfer

- Receipts Report - Bank Transfer

- Notes Receivable Report

- Notes Payable Report

- Bank Statement Report

- Banks Balances Report

Receipts and Payments Reports

The software provides you with a set of unique reports for Treasury transactions, which can identify the details of all receipts/payments were made on a specific treasury– a specific branch– by a specific date…. also, only receipts transactions or payments transactions can be displayed.

Treasury Balance Reports

Through the Treasury Balances reports, you can identify all the treasury balances with all the details, and display all the transactions were made on a specific treasury- a specific date- for a specific branch- for a specific account

Employees Petty Cash Reports

Through the Employees Petty Cash reports, you can display petty cash and settlements for each employee, as well as the petty cash balance.

Notes Receivable Reports

The software provides you with a set of unique reports of the notes receivable, explaining it (Note Amount- Customer Name- Note Number- Bank Name- Issuer Name- Maturity Date....), and all details of the notes receivable, the report receivable can be displayed at the level of a particular bank, customer, branch, or date.

Notes Payable Reports

Treasury& Banking Software provides you with a set of unique reports of the notes payable, explaining it (Note Amount- Supplier Name- Note Number- Bank Name- Maturity Date- Note Status....), and all details of the notes payable, the report can be displayed at the level of a particular bank, supplier, branch, or date.

Check Status Report

Through the Check Status report, it is possible to display all transactions that made on a particular check- several checks or the checks status (delivered- under collection- bounced- canceled- collected ....) and the type of check can be selected whether it is receivable or payable and also the report can be displayed by a specific period/date.

Receipts Report - Cash Transfer

Through the Receipts Report - Cash Transfer, it is possible to display the details of all receipts transfers (Transfer Amount- Transfer Date- Bank Name- Customer Name- Account ...) and the report can also be displayed at the level of a specific bank, or by a specific customer, a specific branch, or by a specific date.

Payments Report - Cash Transfer

Through the Payments Report - Cash Transfer, it is possible to display the details of all payments transfers (Transfer Amount- Transfer Date- Bank Name- Supplier Name- Account ...) and the report can also be displayed at the level of a specific bank, or by a specific supplier, a specific branch, or by a specific date.

Internal Transfers Report

Through the Internal Transfers report, it is possible to display all transfer transactions between the treasury and the bank or between the treasuries or between the banks. The report shows you the treasury/ sending bank as well as the treasury/ receiving bank on a specific date, or at the level of a particular bank, a particular treasury, or at the level of a particular branch.

Letters of Guarantee Reports

Through the Letters of Guarantee report, you can display all the data of the letters of guarantee that made (Letter of Guarantee Number- Letter of Guarantee Date- Letter of Guarantee Expiration Date- Bank Name- Amount- Cover Amount- Customer Name- Account Name- Type of guarantee- Cost Center ...), and all transactions made on the letter of guarantee can be also displayed (Increase value- Extend- Cancel- Liquidate- …..) all the letters of guarantee can be displayed by a specific bank- a specific type of guarantee- a specific date- a specific customer.